Application for tax certificate proving that tax obligations are up to date

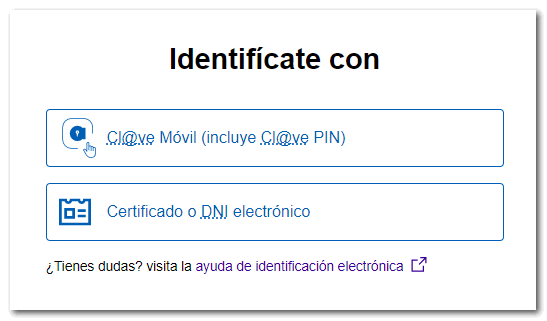

The application for a certificate of compliance with tax obligations is available on the electronic site from the "All procedures", "Certificates", "Tax situation" section. You can identify yourself with Cl@ve and with a certificate or electronic DNI .

Select the type of representation (on your own behalf or on behalf of third parties) and enter the data of the owner only if you are acting on behalf of third parties.

Next, check the box for the type of certificate you are requesting (public sector contracts, transport authorisations, public subsidies, work/residence authorisations for foreigners or generic).

Then, select the date. You can only indicate dates that are within non-prescribed years and if any of the obligations related to said due dates are prescribed on the date of the certificate request, it is not possible to issue the certificate due to prescription reasons. You can select "On the current date" or "On a date in the past", if you check "On a date in the past", the box to set the day, month and year will be enabled and you can select it using the calendar icon.

Click on "Validate request".

In step 2, "Confirm request", verify the data and press "Sign Send".

Check the 'OK' box and click 'Sign and Send' again.

In the last step "3. "Obtain receipt of application" you will obtain proof of submission of the application with information on how you can access the certificate once it has been processed or, if possible, the certificate directly.

You will also receive an electronic Application Code. With this CSV you can download the application receipt or certificate directly from the document comparison of the Electronic Office.

The certificate will be collected immediately provided that the result is positive and the request is made by the interested party on his/her own behalf or through a representative.

If immediate delivery is not possible, after the indicated period of observations and in the receipt of the application, once the certification has been processed by the competent unit, it can be collected using the electronic certificate or Cl@ve of the owner or representative, through the option "Application processing status".

If there are any warnings, please check the information provided.

To download the document click on the button below "Download document".

It can also be collected by accessing the "Consult issued certifications" option.

Requests made by a social collaborator will be sent by CIE / DEHú to the address of the certificate holder.

Furthermore, in the case of consulting the certification through "My Files" of the electronic headquarters, you can access both the electronic declaration (application receipt in PDF ) and the tax certificate . Please note that access to "My Files" requires identification with the electronic certificate or Cl@ve of the holder or being authorized.

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.

However, the authenticity of the document obtained may be verified at any time using the Secure Verification Code ( CSV ) that appears next to the electronic signature of the document, through the "Comparison of documents using a secure verification code" section available at the Tax Agency headquarters.

The certificate of compliance with tax obligations can also be requested at the Administration or Delegation, requesting an appointment in advance, or by telephone; In the latter case, you will have to make an appointment and the AEAT will contact you on the phone number you provide to make the request.