Application for a certificate for contractors and subcontractors

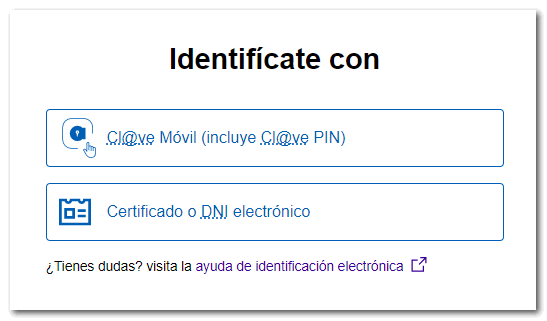

The application for the tax certificate for contractors and subcontractors is available on the electronic site by going to the "All procedures", "Certificates" section. Access requires identification using Cl@ve or using certificate or electronic DNI .

Click on "Application" and confirm the petitioner's details. If you are making the request on behalf of a third party, check the "On behalf of third parties" box and indicate the NIF / NIE , surname and first name of the holder. Next, fill in the NIF / NIE , surnames and first name or company name of the person or entity with whom you contract or subcontract.

Then, select the date. You can only indicate dates that are within non-prescribed years and if any of the obligations related to said due dates are prescribed on the date of the certificate request, it is not possible to issue the certificate due to prescription reasons. You can select "On the current date" or "On a date in the past", if you check "On a date in the past", the box to set the day, month and year will be enabled and you can select it using the calendar icon.

Finally, click on "Validate request".

In the second tab, confirm the registered data and press "Sign Send".

Then, check the "I agree" box and click "Sign and Send" to obtain the certificate or receipt of the request.

Whenever the certificate result is positive and the request is made by the interested party on their own behalf with their electronic certificate or by a representative, the certification can be collected immediately by clicking on "Download document".

Any certifications issued that are not submitted at the time of the application may be found in the "Application processing status" option of the procedures enabled for this certification in the electronic office or through "Consultation of issued certificates".

In addition, if you consult the certification through "My Files" in the Personal Area, you will be able to access both the electronic declaration (receipt of the application in PDF ) and the tax certificate. Remember that access to "My files" requires identification with the Cl@ve system, with the certificate/ DNI electronic number of the holder, or being authorized to carry out that specific procedure.

The certification can also be requested at the offices of AEAT by completing form 01C. To go to the Administration to process the certification, it is necessary to have previously requested an appointment.

If requested using form 01C, the certificate will be sent to the applicant according to the following order of priority:

1. To the address indicated for this purpose in the application (in the case of applications submitted to an Administration of the AEAT )

2. To the electronic address (Enabled Electronic Address) if you have subscribed to the Electronic Notification Service

3. To the address indicated for notification purposes in forms 030 / 036 / 037

4. To the tax domicile

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.

Remember that, in any case, the authenticity of the document obtained can be verified at any time using the Secure Verification Code ( CSV ) that appears next to the electronic signature of the same, through the section "Comparison of documents using a secure verification code" available at the headquarters of the Tax Agency.