How to file a tax return for Wealth Tax by file generated with an assistance program

It is possible to submit the form by file, if you have a file that conforms to the specific registration design for Form 714 for the 2024 fiscal year. This file can be obtained from applications external to the Tax Agency or from the Wealth Tax declaration processing service available on the electronic site, by exporting the declaration.

You can identify yourself with Cl@ve , with reference, with certificate or DNI electronic.

After identifying yourself and reviewing the submission requirements, you can select the file using the "Read Declaration" button ## .

A summary of the declaration will be uploaded with the identification data, the economic data and the result of the declaration.

At the bottom are the available options. Under the button "View File" you can view the uploaded encrypted file. By clicking on the X or pressing "Cancel" you can return to the declaration.

To continue with the presentation you have the button "Formalize Income / Refund" . A new window will appear where you can choose the desired payment method and fill in the corresponding data if it has not been specified in the file.

Then press "Sign and Send" . Check the box "Agree" and press "Sign and Send" to finish the presentation.

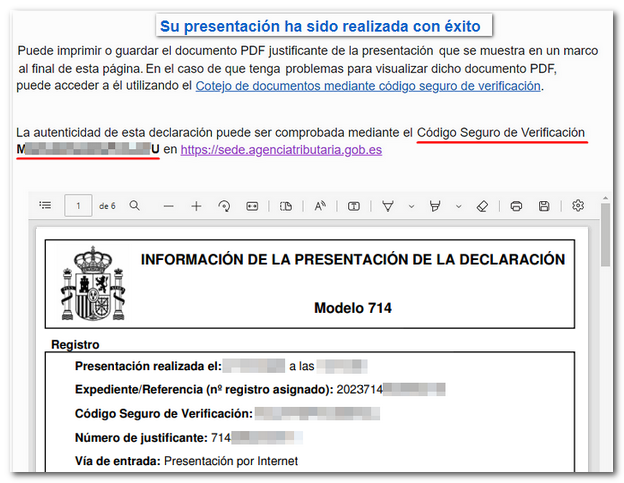

The result of a correct submission will be the receipt, with the CSV assigned and an embedded PDF containing the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission, and submitter details) and the full copy of the declaration.