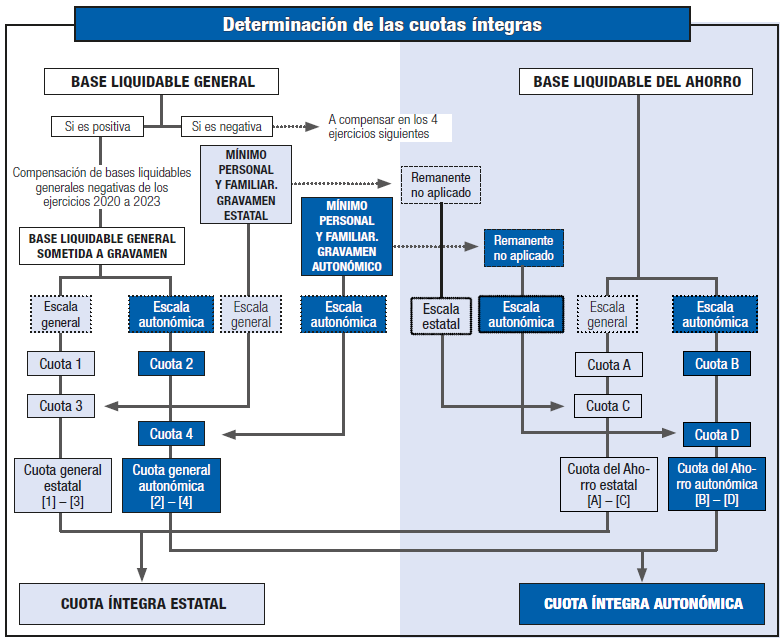

Graphic scheme: Application of personal and family minimum and determination of full contributions

Taxation of the general taxable base

The taxation of the general taxable base of personal income tax is structured in four phases:

Phase 1: The general and regional scales of IRPF are applied to the entire general taxable base, including the amount corresponding to the personal and family minimum that forms part of it, obtaining the corresponding partial quotas (Quota 1 and Quota 2).

Phase 2: The general scale of IRPF is applied to the part of the general taxable base corresponding to the state personal and family minimum established in the Personal Income Tax, obtaining the partial quota (Quota 3).

Phase 3: The corresponding autonomous scale is applied to the part of the general taxable base corresponding to the personal and family minimum increased or decreased by the amounts established, where applicable, by the Autonomous Community in its autonomous regulations, obtaining the partial quota (Quota 4).

The Autonomous Community of Andalusia, the Autonomous Community of Galicia, the Autonomous Community of the Balearic Islands, the Autonomous Community of the Canary Islands, the Community of Madrid, the Autonomous Community of La Rioja and the Valencian Community have regulated personal and family minimum amounts different from those established in the Tax Law. Consequently, taxpayers resident in its territory must apply, for the purposes of the autonomous tax (phase 3), the amounts regulated in the regulations of said Autonomous Community.

All other taxpayers (including those in the Autonomous Communities of Catalonia and Castile and León, which have set minimum personal and family tax amounts identical to those established in the Personal Income Tax Law) must apply the same amount of minimum personal and family tax for the purposes of the state tax (phase 2) and the regional tax (phase 3).

Phase 4: The general state full quota (Quota 1 minus Quota 3) and the general autonomous full quota (Quota 2 minus Quota 4) are calculated from the four partial quotas obtained.

Taxation of the taxable base of savings

The taxation of the taxable base of personal income tax savings is structured in four phases:

Phase 1: The amount of the taxable base for savings is taxed at the state and regional savings scale rates set for 2024, resulting in the corresponding partial quotas (Quota A and Quota B).

Phase 2: The amount of the state contribution resulting from applying the scale to the taxable base for savings (Quota A) will be reduced, where applicable, by the amount derived from applying the state savings scale set for 2024 (Quota C) to the remainder of the state personal and family minimum not applied (that is, to the excess of the aforementioned minimum over the amount of the general taxable base).

Phase 3: The amount of the regional quota resulting from applying the scale to the taxable base for savings (Quota B) will be reduced by the amount derived from applying the regional savings scale set for 2024 (Quota D) to the unapplied remainder of the regional personal and family minimum (that is, to the excess of the aforementioned minimum over the amount of the general taxable base).

Phase 4: From the four partial quotas obtained, the full quota of state savings (Quota A minus Quota C) and the full quota of regional savings (Quota B minus Quota D) are calculated.