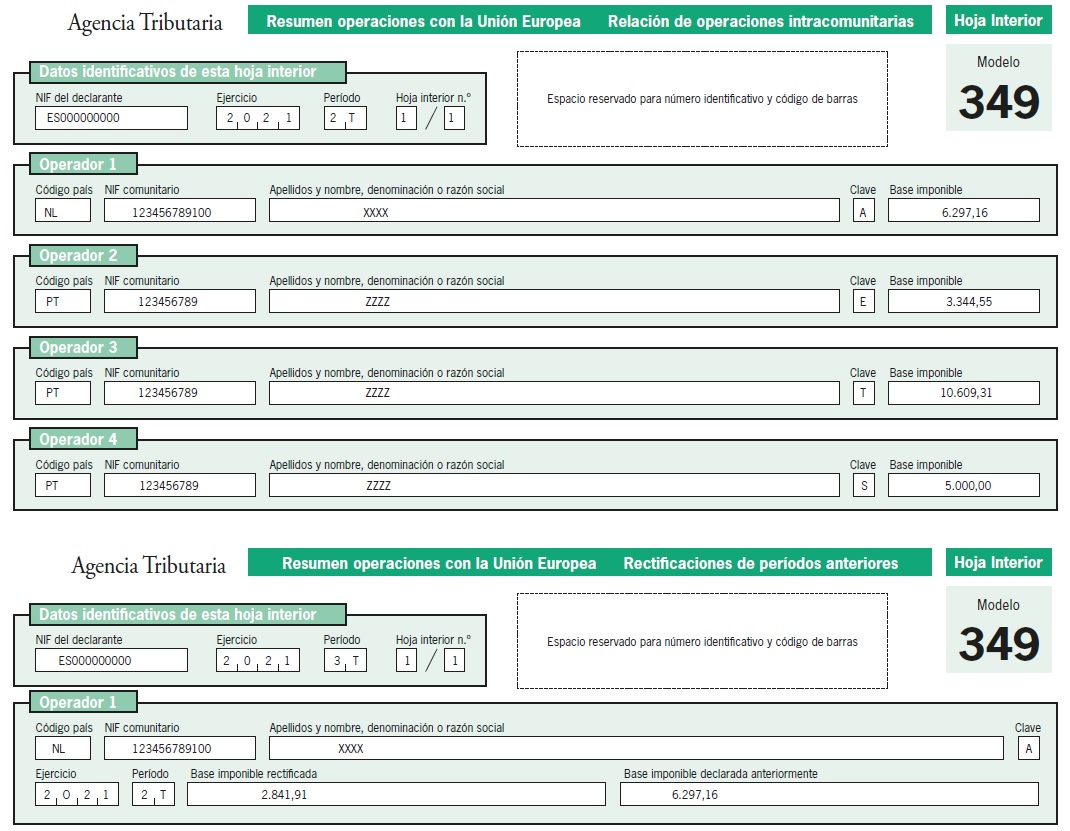

Practical example

Operations carried out by the Spanish taxpayer ES000000000 during the month of May 2024:

-

He purchased two batches of goods from the Dutch businessman NL123456789100, one on 12 May for an amount of 3,455.25 euros and another on 15 May for an amount of 2,841.91 euros.

-

Makes a delivery of machines to the Portuguese businessman PT123456789, valued at 3,344.55 euros.

Makes a purchase from the Greek taxpayer EL999999999 for the amount of 10,533.01 euros, with the goods being made available in Portugal, where the Spanish taxpayer subsequently makes a delivery of the same goods to the taxpayer PT123456789, for the amount of 10,609.31 euros mentioned in the previous paragraph, all by virtue of a triangular operation:

-

An appraisal is carried out on a Portuguese businessman PT123456789 for an amount of 5,000 euros.

Operations carried out by the Spanish taxpayer ES000000000 during the month of September 2021.

-

The first transaction of 3,455.25 euros carried out with the Dutch businessman NL123456789100 is hereby cancelled, the products are returned and the amount is refunded.