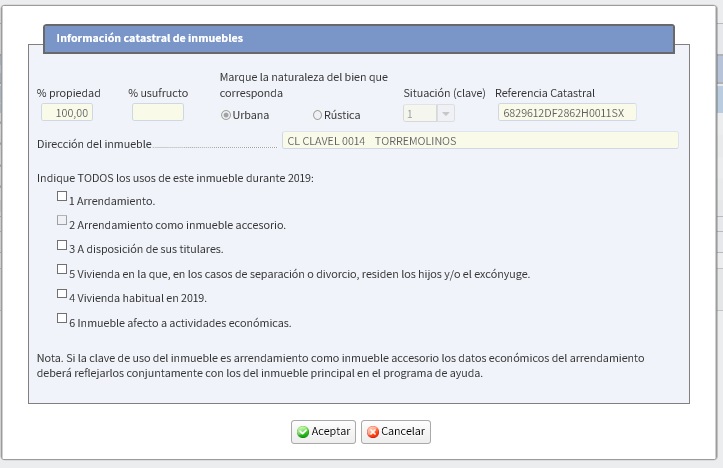

New features regarding entering properties with Renta WEB

This year a number of changes have been made to the way in which taxpayers will complete the sections relating to property in Renta WEB.

The main changes are as follows:

1.- Simultaneous entry of the different uses of a property during the financial year:

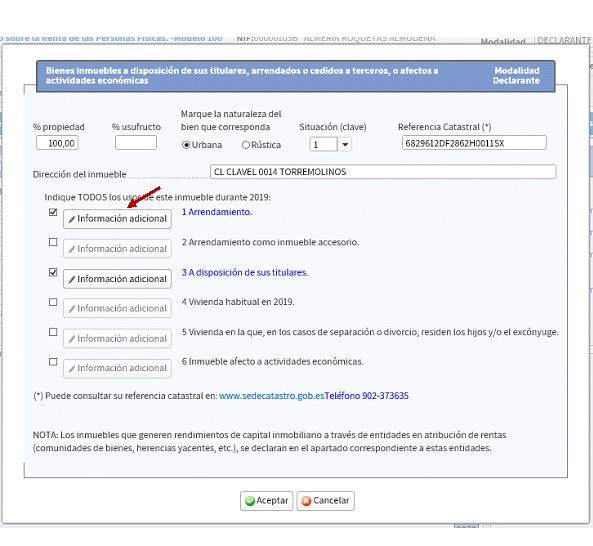

With the current system, all the uses to which the property has been put during the year can be reflected altogether by selecting them with a click on the drop-down menu which will open when selecting each property.

Note that this plurality of uses can occur simultaneously or successively over time.

Example:

- A taxpayer who uses a residence partly for his professional practice and partly for his main residence will select both uses: "6 Property used for economic activities" and "4 Principal residence in 2019", 365 days a year.

- A taxpayer who has a second home on the beach or in the mountains at his disposal all year round - except for the months of July and September when he rents it out - will select the use “3 At the disposal of its owners”, for 304 days (365-31-30) and the use “1 Lease”, where he will indicate the duration of each contract.

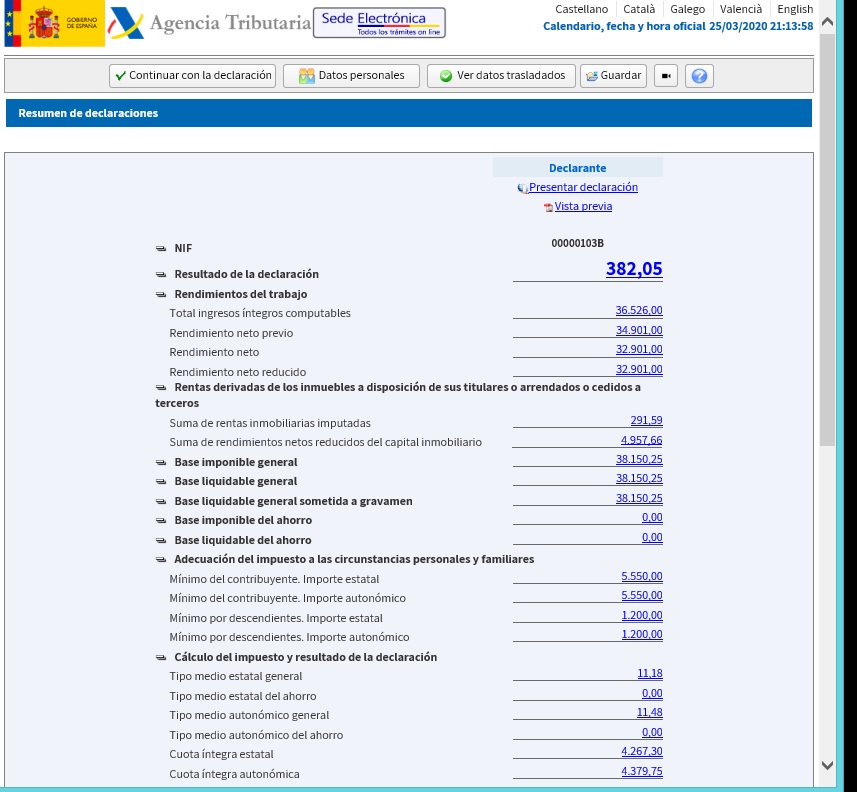

The sequence of screens for the first example is shown below:

- 1 Screen: The property is selected when entering the tax information on the tax return.

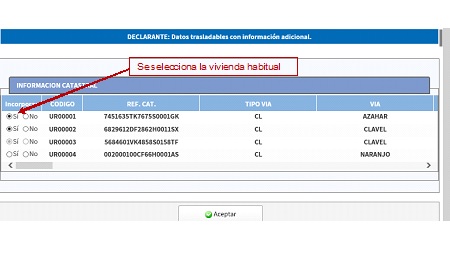

- 2 Screen: The uses "4 Principal residence in 2019" and "6 Property used for economic activities" are selected with two clicks.

- 3 Screen: The information requested for these uses is filled in.

1 screen:

2 screen:

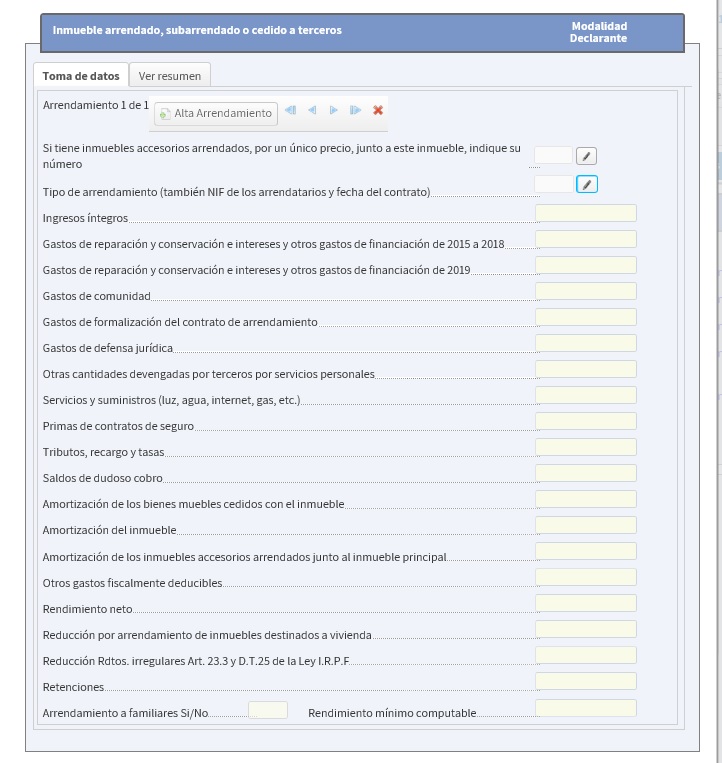

3 screen:

2.- Special features regarding entering leased properties:

2.1.- Main issues

Because the amount of information to be filled in is greater in the case of leased properties, the process is staggered to be able to enter all the information relating to the leases.

Therefore:

- When incorporating the property, and with regard to use "1 Leasehold", this use shall be selected and, where appropriate, the accessory properties to be included with the main property for a single price shall be indicated. If the property has other uses during the year, these shall also be selected and the information about them filled in.

- When you reach the Tax Return Summary, the income originating from the different properties will appear, except for those derived from the lease, where a "Pending" will appear.

- By clicking on Pending in the Tax Return Summary, you will access the section on properties, where all the properties will be listed along with an indication of their use. In the case of leases, a pending amount will be shown, because you still need to include the various deposits and expenses of the lease.

- By clicking on Pending of the leased property, the programme will bring up the leased property to enter the lease information.

Accessory properties:

Use "2 Leased as an accessory property" is not selected by clicking directly on this use. When selected as an accessory to the main leased property, the programme itself marks use "2 Leased as accessory property". Should this accessory property have any other use during the year, this must be added when selecting the accessory property from the main one, by opening the drop-down menu of that accessory property.

Example:

Let’s look at an example of what has been explained above with regards to leases:

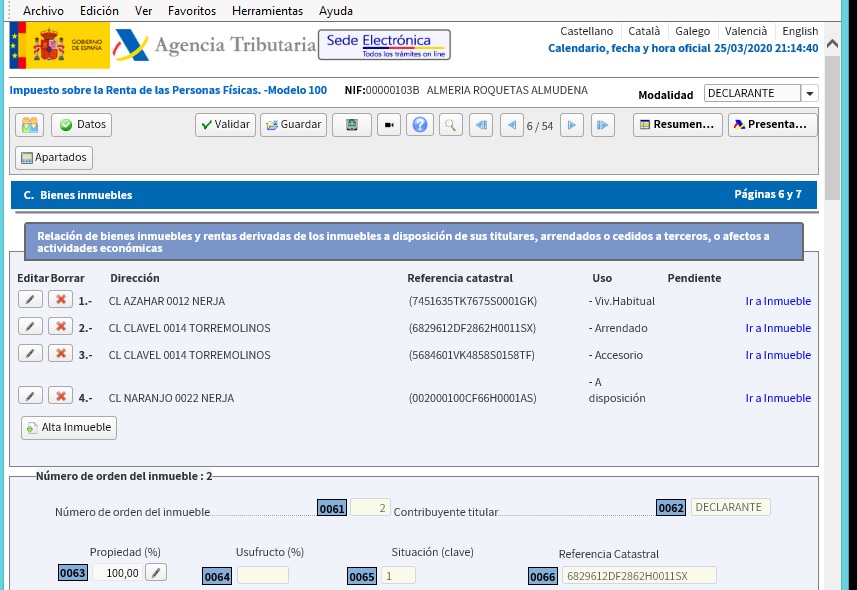

Taxpayer with 4 properties:

Property C/ Azahar: taxpayer's principal residence for the entire year.

Properties in C/ Clavel: a house and a parking space. They are at the taxpayer’s disposal for January and February and subsequently rented from March to December under the same contract and at the same price, for office use.

Property C/ Naranjo: is a parking space that the taxpayer has at his disposal all year round, right next to his place of work.

The principal residence in C/ Azahar is incorporated in the:

We incorporate its use and the days of this use in 2019:

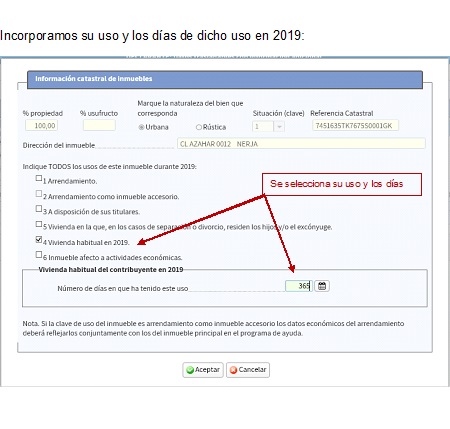

We incorporate the leased property in C/ Clavel:

We select use "1 Lease" for the contract from March and use "3 At the owners’ disposal" for the months of January and February.

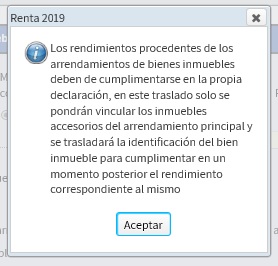

The programme warns us that the lease information will be entered later and that we now have to link the accessory properties, if there are any.

In the information entry screen of the main building in Clavel St. (leased), you will find the drop-down menu of the information entry screen for the accessory buildings. We enter the days of own use of the main building and we open the window of the accessory buildings.

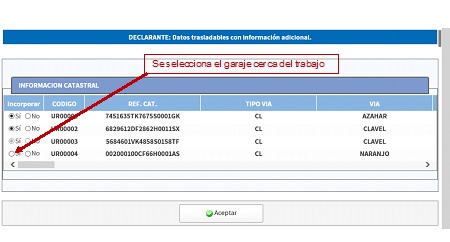

We enter the days of own use of the main building (31 + 28 = 59) and choose which one is the accessory building. The programme shows all those from which to choose:

Since the accessory property (also located in C/ Clavel) also has other uses, in addition to selecting the main use we will open its information entry screen to click on its other use (in this case, the second use, "3 At the disposal of its owners", is the same as for the main property and the days of own use also coincide, but this does not always have to be the case).

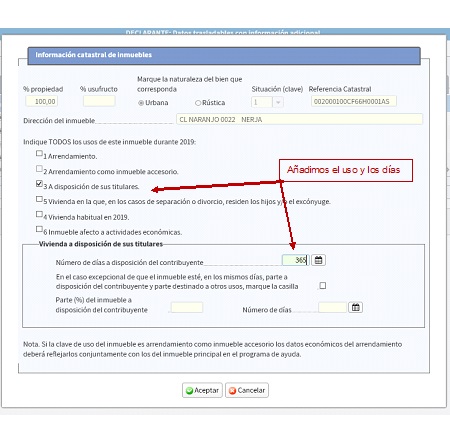

We incorporate the last property in C/ Naranjo; this is the parking space that is only for own use:

We incorporate its use and the days of this use:

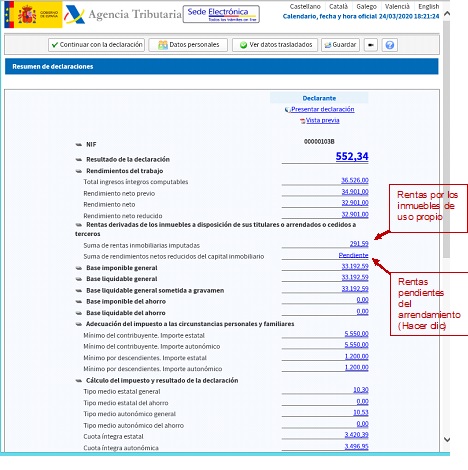

Once we have finished downloading our other tax information, we will come to the Tax Return Summary.

The income derived from the properties will already have been calculated in the return, except for the income derived from the leased properties (main and accessory), which will be shown as pending:

By clicking on pending earnings from real estate, you can access the properties in the tax return:

We will select the pending property to enter the information about property 2:

Once in property 2 (main lease) we will open its drop-down menu and fill in the additional information about the tenancy.

2.3.- Data capture about the lease contract:

Having clicked on additional information we will proceed with entering the lease information.

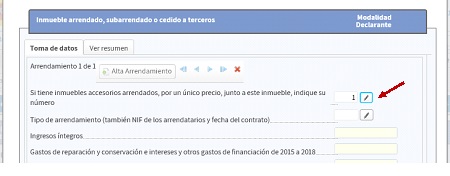

The first item of information is the accessory property. We have already listed it in the tax information download.

If we access it, we can see it. Up to three accessory properties can be listed

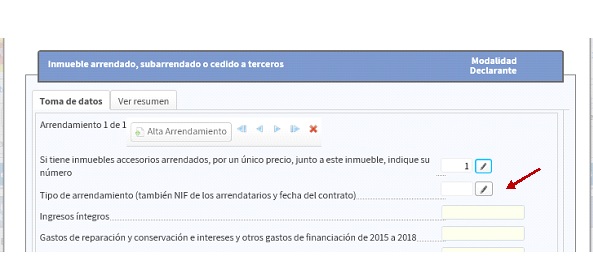

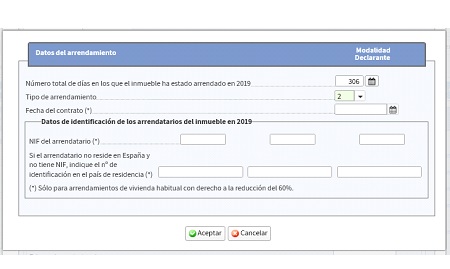

2.3.1.- Contract details

We will fill in the lease days as 306 and the lease type; in our example it is an office, therefore number 2: leasing property other than the principal residence with the right to a 60% reduction.

The date of the contract and the tenant's tax identification number is only compulsory for leases of principal residencies. In our example this is not necessary.

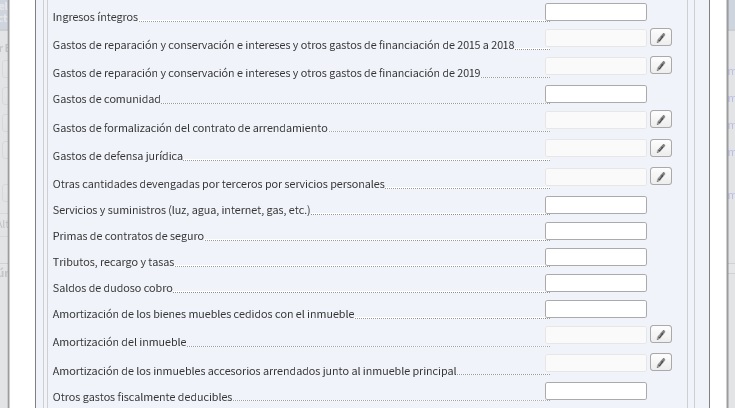

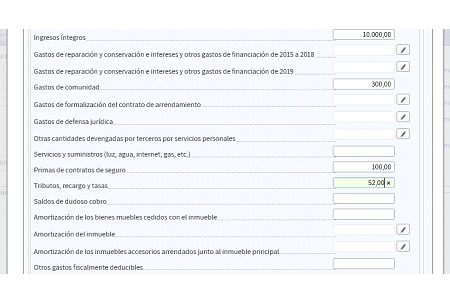

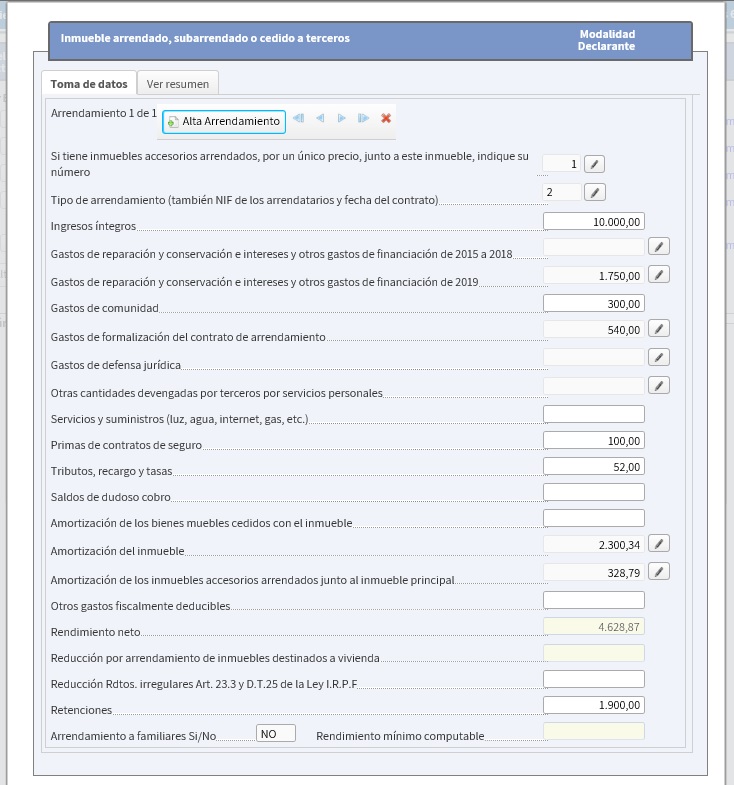

2.3.2.- Income, expenses and withholdings:

We will then complete the information regarding income and the various expenses and withholdings, where applicable.

Some of these boxes are filled in directly. For example, those relating to income, community charges, utilities, insurance, taxes or doubtful balances and withholdings.

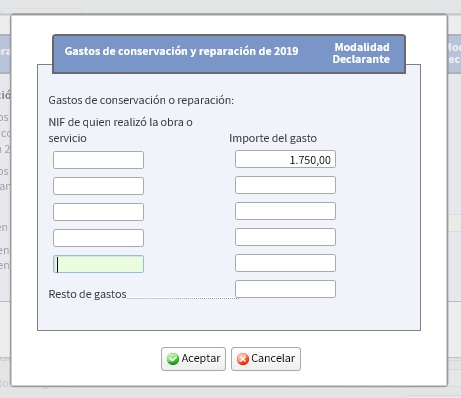

In other cases, a drop-down menu opens to enter the amount of each invoice, with the VAT number of the person carrying out the work or service.

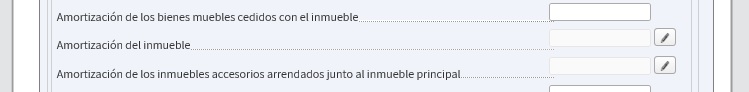

2.3.3.- Depreciations

Several cases must be distinguished:

-

The depreciation of the furniture that is rented with the property.

-

The depreciation of the main property, including improvements, if any, that have been made to it.

- The depreciation of associated properties, including improvements, if any, that have been made to them.

Depreciation of movable assets:

Depreciation of furniture is entered directly in the box. Each year thus is 10% of the justified purchase amount until they are fully amortised.

Depreciation of the main building:

The depreciation will be 3% of the higher amount of the assessed value or the acquisition cost, in both cases excluding land.

General rule:

We will complete:

- If the acquisition is onerous (sale...) or lucrative (inheritance...).

- Acquisition date

- The total assessed value and the value of the construction.

- The acquisition amount and the acquisition costs.

With this information the program will calculate the amount of depreciation.

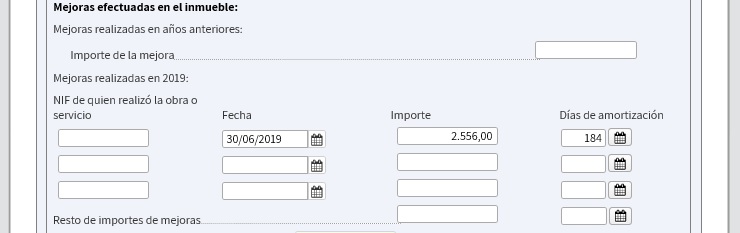

Improvements:

If improvements have been made to the main property, the boxes relating to these should also be completed.

If the improvement was made before 2019, simply enter the full amount in the box.

If the improvements were carried out in 2019, the tax identification number of the person carrying out the work, the date, the amount and the days of amortisation must be entered. (For example, if we had made an improvement on 1 July - installation of air conditioning that did not previously exist - we could only depreciate it by half a year in 2019).

With this information the program will calculate the amount of depreciation.

Depreciation in special cases

In the following cases:

- You have the usufruct of the property

- The land and the building have been acquired separately

- In 2019, only part of the real estate has been acquired or transferred

- Only part of the property has been rented

- Part of the property has been acquired against payment and part free of charge.

The property has not been assigned an assessment value.

The programme does not calculate depreciation. Therefore, the above sections should not be completed and the amount should be entered in the specific box for depreciation in special cases.

You can find examples of calculations in these cases in the program help.

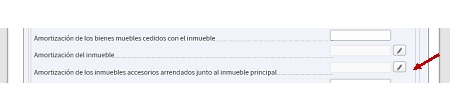

Depreciation of associated buildings:

The depreciation of associated properties is carried out in the same way as for the main property. However, the amount shall be entered in its specific box.

When you click here, you will be shown the associated properties to be able to enter the depreciation for each one.

In our example we have only one:

The capture window has the same format as previously commented for the one for the main building, but the associated building is identified.

We complete this information in the same way as for the main property.

When we have finished, we now have all the information entered in our tax return and the reduced net income derived from the rent has been calculated.

We can now return to the Tax Return Summary

Where the earnings from real estate capital will appear in full: