Completing the deduction. Exercise 2022

The maternity deduction is automatically calculated by Renta WEB, although when you have been unemployed during 2022, including the new circumstances that now entitle you to the deduction, when accessing the declaration it will be necessary to provide information relating to the Maternity Deduction.

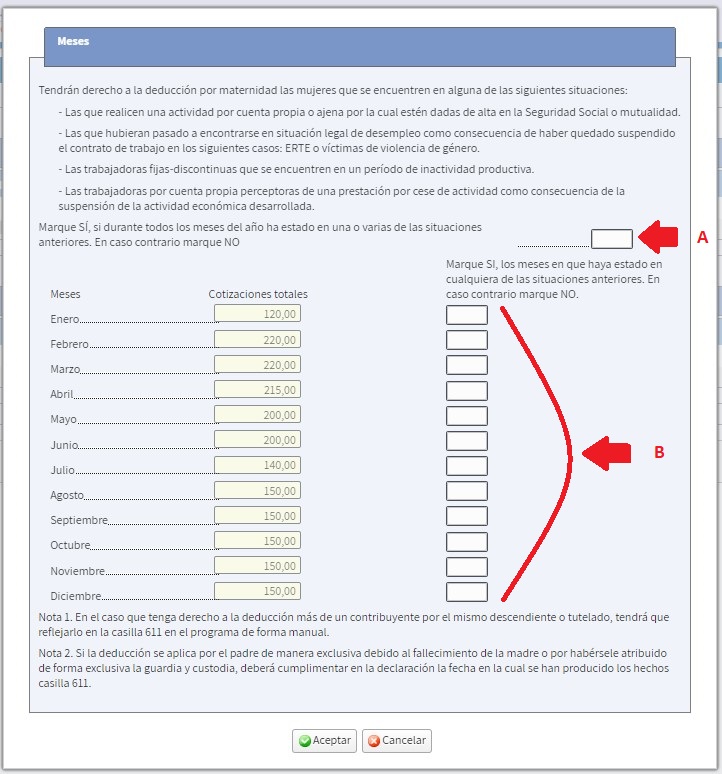

Specifically, the following must be indicated:

-

If during all the months of 2022 you have been in one or more situations that grant the right to the deduction, mark YES or NO.

-

In the event that it is indicated that you have NOT been in one of these situations every month, you will have to mark YES for each of the months in which any of the situations have occurred or NO when none of them have occurred. The total amount of contributions is already reflected.

For example, a taxpayer had a child on 08/01/2020 (being working since before the birth of that child) and remains active until 09/30/2021 when she is placed in the ERTE situation with total suspension until 02/01/2022 when she resumes work. Subsequently, on 05/30/2022, he/she became unemployed.

In addition, the son has attended a daycare center during all the months of 2021 and 2022 except for the month of August of each year.

In 2020 and 2021, she already included in her declaration the amounts relating to the maternity deduction and the increase in childcare expenses that corresponded to her according to the original regulation of this deduction.

In the present example, this taxpayer, in the 2022 Income Tax Return, will be entitled to the maternity deduction for the months in which she is active (February to May) or in one of the new situations (January when she is in ERTE of total suspension). You are not entitled to the maternity deduction between the months in which you are unemployed (June to December).

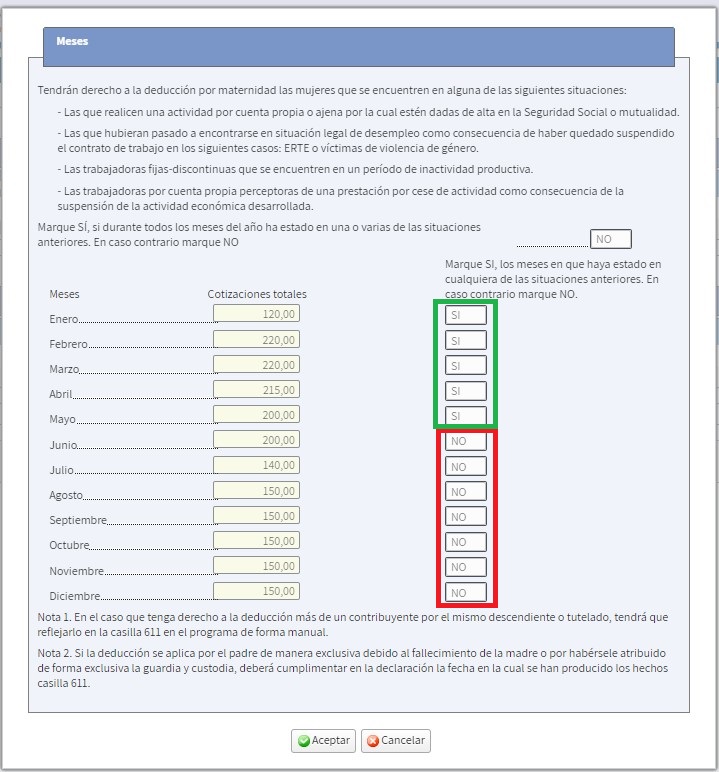

Therefore, “Yes” will be marked in the months of January to May and “NO” in the months of June to December:

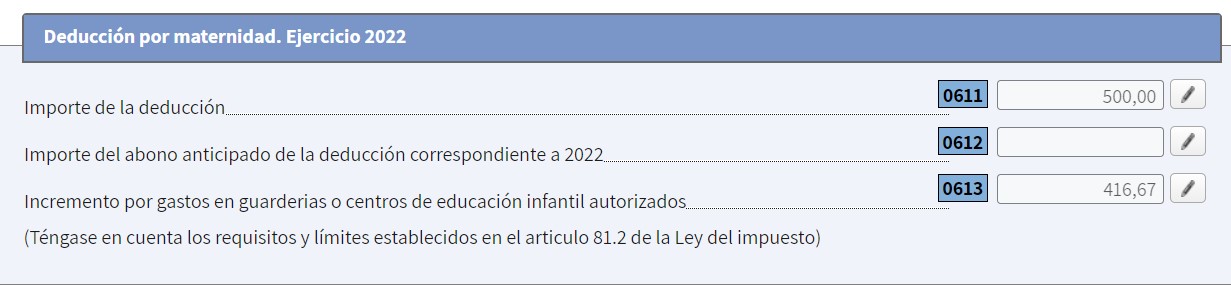

With this information provided, Renta Web calculates the amount of the “Maternity deduction.” Exercise 2022” which amounts to a total of €100/month for each of the five months to which you are entitled, i.e. €500.

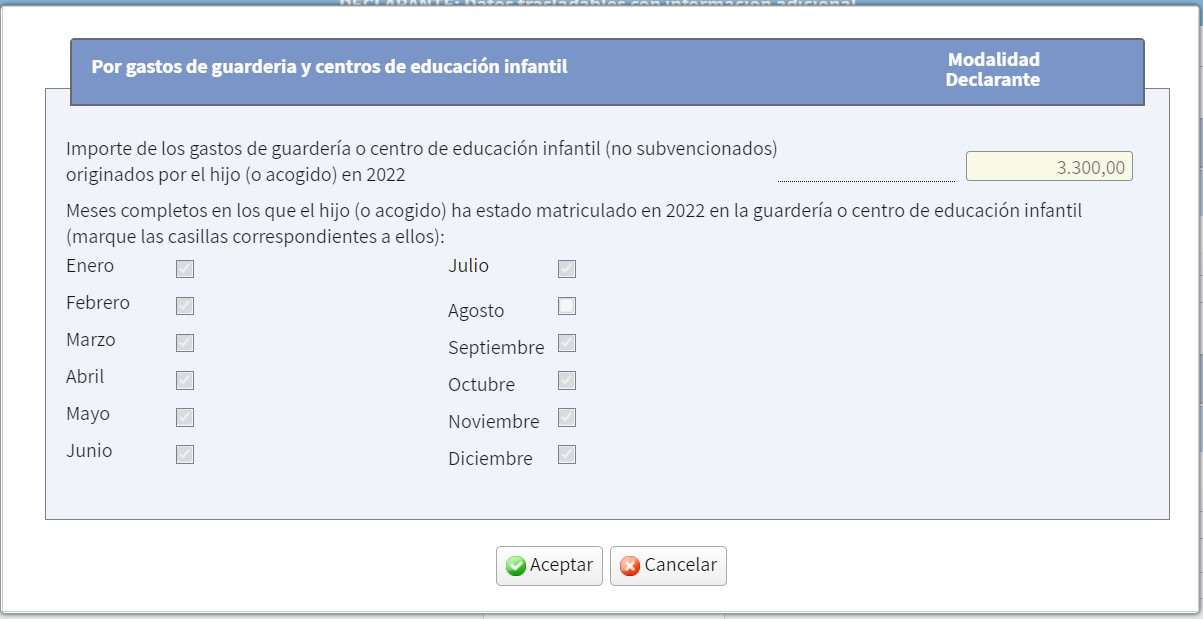

On the other hand, it will also be necessary to confirm that the information provided by the nursery is correct, so you will have to access the additional information screen where you can verify the amount of expenses paid by the child and the months in which he/she has attended in 2022. In our example, the annual expenses would be €3,300 for all months of the year except August, as can be seen in the following screen.

The amount of the deduction will be the one corresponding to the months in which the person was in one of the situations that generate the right during 2022, in this case from January to May inclusive. Therefore, the amount of the increase for childcare expenses calculated by Renta WEB will amount to a total of €83.33/month x 5 months: 416,67 €.

Once the above information has been accepted and after accessing the declaration, you will be able to see the amount corresponding to the maternity deduction in box 0611 and the amount corresponding to the increase in childcare expenses in box 0613: