Example. Son attended daycare in the exercise before

A taxpayer started working as a temporary permanent worker in January 2021. In 2021 he worked from January 8 to June 24 and from September 7 until the end of the year.

Has a son born on 10/11/2018. He attended daycare between January and July 2021, paying a total of €3,500 (€500/month).

In her 2021 Income Tax return, the taxpayer applied the maximum amount that corresponded to her from the maternity deduction and the increase for childcare expenses in accordance with the regulations in force at that time.

Analyze the effect of the extension of the maternity deduction to the new circumstances for the year 2021 knowing that the amount of total contributions and fees (of the worker and the company) to Social Security is as follows: €200 for the months in which he/she is working and €110 in July and August.

Solution :

-

EXISTING SITUATION UNTIL 31/12/2022 (original regulations):

1.1. Maternity deduction in Income Tax 2021:

The requirements for carrying out an activity as a self-employed person or employed by another person with registration with Social Security and having a child under 3 years of age simultaneously occur during the months of January to June and in September, a total of 7 months given that the child has turned 3 years old in October (the month in which the child turns 3 years old does not count since the month of birth does count) and the mother has worked the months of January to June and September to December. It is enough to have worked one day in the month for that month to be eligible for the maternity deduction.

In the 2021 Income Tax Return, she reported the maternity deduction for an amount of €700:

-

Maximum deduction originally possible: 7 months (January to June and September) x €100/month = €700.

-

Contribution limit (contributions during the months in which the child is under 3 years old): €200/month x 7 months (January to June and September) + €110/month x 2 months (July and August) = €1,620.

The limit does not operate.

-

Maternity deduction in Income Tax 2021 = €700.

1.2 Increase for childcare expenses in Income Tax 2021:

In 2021, it was calculated proportionally to the number of months in which the requirements for its application were met, in this case from January to June. In July, I was not entitled to the increase for childcare expenses because I was not entitled to the maternity deduction.

For each month that he met these requirements, he was entitled to an increase of €83.33 (€1,000 / 12 months).

-

Maximum possible deduction amount originally = 6 months (January to June) x €83.33/month = €500.

-

With the limit of the lesser of the following amounts:

-

Contributions accrued up to the month prior to the month in which the child can begin the second cycle of early childhood education, that is, from January to August inclusive = €200/month x 6 months (January to June) + €110/month x 2 months (July and August) = €1,420.

-

Quantities satisfied: 3,500 €.

The limits do not apply as they are higher than the maximum amount to be applied.

-

-

Increase for expenses in authorized nurseries or early childhood education centers applied in Income 2021: 500 €.

-

-

EXTENSION OF THE MATERNITY DEDUCTION AND THE INCREASE IN DAYCARE EXPENSES IN 2021 IN INCOME TAX FOR 2022.

2.1. Extension in Income 2022 of the Deduction for maternity 2021:

With the extension of the maternity deduction to the new circumstances that include the case of permanent-discontinuous workers who are in a period of productive inactivity, in the 2022 Income Tax return they will be able to include the deduction for the rest of the months of 2021 for which they are now entitled, that is, July and August.

In this way, instead of 7 months, you will be entitled to 9:

-

New maximum possible deduction: 9 months (January to September) x €100/month = €900.

-

Contribution limit (during months when the child is under 3 years old): €200/month x 7 months (January to June and September) + €110/month x 2 months (July and August) = €1,620.

-

New amount of maternity deduction = €900.

-

Amount of deduction applied in 2021: 700 €.

-

Extension of the 2021 maternity deduction to be received in Income Tax 2022: 900 – 700 = 200 €.

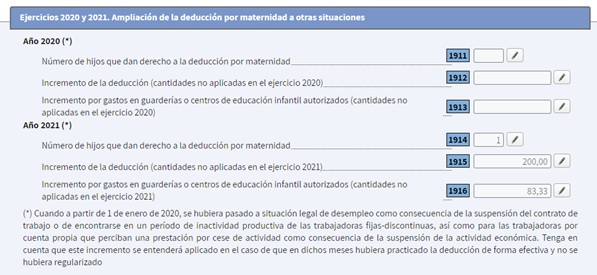

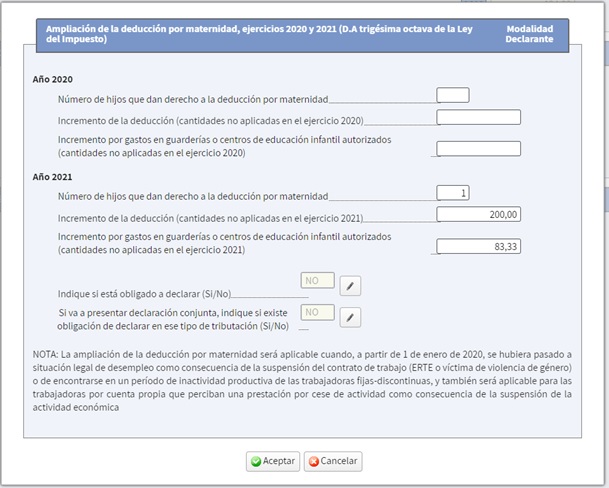

This amount must appear in box of the 2022 Income Tax Return “Increase in deduction (amounts not applied in fiscal year 2021)”.

2.2. Extension in Income Tax 2022 of the Deduction for increased childcare expenses 2021:

With the extension to the new circumstances that includes the case of fixed-discontinuous workers who are in a period of productive inactivity, in the 2022 Income Tax return they will be able to include the deduction for the month of July in which the child went to daycare and which was not included in the 2021 Income Tax return as this right does not exist.

This way, instead of 6 months, you will be entitled to 7:

-

New maximum possible deduction amount = 7 months (January to July) x €83.33/month = €583.33.

-

With the limit of the lesser of the following amounts:

-

Contributions accrued up to the month prior to the month in which the child can begin the second cycle of early childhood education, that is, from January to August inclusive = €200/month x 6 months (January to June) + €110/month x 2 months (July and August) = €1,420.

-

Quantities satisfied: 3,500 €.

The limits do not apply as they are higher than the maximum amount to be obtained.

-

-

New amount of the increase in the deduction for childcare expenses: 583,33 €.

-

Amount applied in 2021: 500 €.

-

Extension of the deduction for the increase in expenses in authorized nurseries or early childhood education centers in 2021 to be received in Income Tax 2022: 583.33 – 500 = €83.33.

This amount must appear in box of the 2022 Income Tax Return “ Increase for expenses in authorized nurseries or early childhood education centers (amounts not applied in fiscal year 2021)”.

In the 2022 Income Tax Return these amounts will appear in boxes 1915 and 1916:

And inside those boxes:

-