Example: Son born in 2020

A taxpayer has a child born on 04/13/2020 (being working since before the birth of that child) and remains active until 11/03/2020, when she is placed in the ERTE situation with total suspension, a situation in which she remains until 04/03/2021. From that date the taxpayer returns to work.

The total monthly contributions and fees (of the worker and the company) to Social Security amount to €200.

In her 2020 and 2021 Income Tax returns, the mother received the maximum amounts that corresponded to her from the maternity deduction in accordance with the regulations in force at that time.

Analyze the effect of the extension of the maternity deduction to the new circumstances for the years 2020 and 2021 in Income 2022.

Solution

-

EXISTING SITUATION UNTIL 31/12/2022 (original regulations):

The son was born on 04/13/2020, so he is under 3 years old in both years.

1.1. 2020 Income Tax Return.

The requirements for carrying out an activity as a self-employed person or as an employee with registration with Social Security and having a child under 3 years of age simultaneously occur during the months of April to November 2021, that is, for 8 months in the year.

In relation to April, it is taken into account when calculating the month of birth and November is also counted since it is sufficient to have worked one day in the month for that month to be able to apply the maternity deduction.

In the 2020 Income Tax return, she reported the maternity deduction for an amount of €800:

-

Maximum deduction originally possible: 8 months (April to November) x €100/month = €800.

-

Contribution limit ( annual contributions from the month of birth of the child , that is, from April to December): 9 months x €200/month = €1,800.

The limit does not operate.

-

Maternity deduction in Income Tax 2020 = €800.

1.2 2021 Income Tax Return.

The requirements for carrying out an activity as a self-employed person or as an employee with registration with Social Security and having a child under 3 years of age simultaneously occur during the months of April to December 2021, that is, for 9 months in the year.

In the 2021 Income Tax Return, she reported the maternity deduction for an amount of €900:

-

Maximum deduction originally possible: 9 months x €100/month = €900.

-

Contribution limit (annual contributions for children under 3 years of age for the entire year): 2,400 €. The limit does not operate.

-

Maternity deduction in Income Tax 2021 = €900.

-

-

EXTENSION OF THE MATERNITY DEDUCTION IN INCOME TAX 2022 FOR THE YEARS 2020 AND 2021.

With the extension of the maternity deduction to the new circumstances that include the case of self-employed workers who become legally unemployed due to their employment contract being suspended in the event of a ERTE with total suspension, in the 2022 Income Tax Return will be able to include the deduction for the remainder of the months of 2020 and 2021 for which they are now entitled.

In this case, in 2020 you will also be entitled to benefit for December and in 2021 for the months of January, February and March.

2.1 Extension of the 2020 maternity deduction in Income Tax 2022.

You are now entitled to benefit for every month since your child was born, i.e. for 9 months instead of the original 8.

-

New maximum possible deduction: 9 months x €100/month = €900.

-

Contribution limit (annual contributions from the month of the child's birth, i.e. from April to December): 9 months x €200/month = €1,800.

The limit does not operate.

-

New amount of maternity deduction = €900.

-

Amount of deduction applied in 2020: 800 €.

-

Extension of the 2020 maternity deduction to be received in Income Tax 2022: 900 – 800 = 100 €.

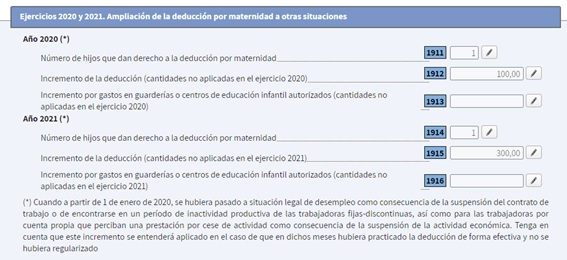

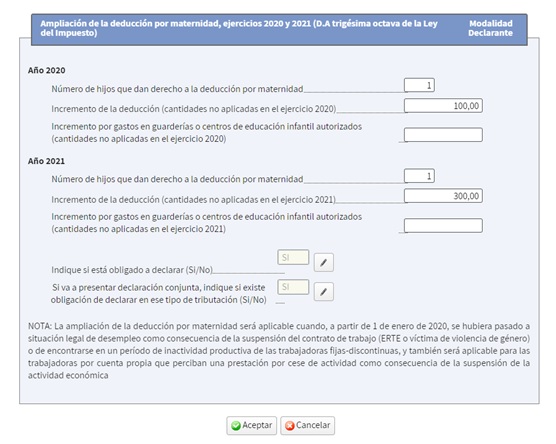

This amount must appear in box of the 2022 Income Tax Return “Increase in deduction (amounts not applied in fiscal year 2020)”.

2.2. Extension of the 2021 maternity deduction in Income Tax 2022.

Now you are also entitled to it for the months of January to March. Therefore, you are entitled to 12 months instead of the original 9 months.

-

New maximum possible deduction: 12 months x €100/month = €1,200.

-

Contribution limit (annual contributions for children under 3 years of age for the entire year): 2,400 €. The limit does not operate.

-

New amount of maternity deduction = €1,200.

-

Amount of deduction applied in 2021: 900 €.

-

Extension of the 2021 maternity deduction to be received in Income Tax 2022: 1,200 – 900 = €300.

This amount must appear in box of the 2022 Income Tax Return “Increase in deduction (amounts not applied in fiscal year 2021)”.

Completion in Renta Web 2022 :

-