Example. Mother with two children

A taxpayer has two twin children who were born on 08/01/2019. He had been working since before the birth of those children and remained active until 03/27/2020, when he became in the ERTE situation with total suspension, a situation in which he remained until 01/04/2021, the day in which who went back to work.

The taxpayer applied the maximum amount of the maternity deduction corresponding to the 2020 and 2021 income tax returns in accordance with the regulations in force at that time.

Analyze the effect of the extension of the maternity deduction to the new circumstances for the year 2020, knowing that the amount of total annual contributions and fees (of the worker and the company) to Social Security amounted to €1,360.

Solution:

-

EXISTING SITUATION UNTIL 31/12/2022 (original regulations):

The children have been under 3 years old throughout 2020. The mother has worked the months of January, February and March. It is enough to have worked one day in the month for that month to be eligible for the maternity deduction.

The calculations must be carried out separately for each of the children.

In the 2020 income tax return, the maternity deduction was recorded in the amount of €600 (€300/child):

-

For the first child:

-

Maximum deduction originally possible: 3 months x €100/month = €300.

-

Annual contribution limit: €1,360.

-

Maternity deduction in 2020 Income for the first child = €300.

-

-

For the second child:

-

Maximum deduction originally possible: 3 months x €100/month = €300.

-

Annual contribution limit: €1,360.

-

Maternity deduction in 2020 Income for the second child = €300.

-

Total amount of maternity deduction in Income 2020: €600.

-

-

INCREASE EXTENSION IN 2022 OF THE MATERNITY DEDUCTION YEAR 2020 .

With the extension of the maternity deduction to the new circumstances that includes the case of employed workers who become legally unemployed due to having their employment contract suspended in the case of ERTE with total suspension, in the declaration of Income 2022 may include the deduction for the rest of the months of 2020 for which you are now entitled, that is, from April to December.

In this way, as you have worked the months of January, February and March (3 months) and have been in ERTE with total suspension for the rest of the year 2020 (9 months), you now have the right for the 12 months of the year for each of their children.

-

For the first child:

-

New maximum possible deduction: 12 months x €100/month = €1,200.

-

Annual contribution limit: €1,360.

-

New amount of maternity deduction = €1,200.

-

Amount of deduction applied in 2020: €300.

-

Extension of the 2020 maternity deduction to be received in 2022 income for the first child: 1,200 – 300 = €900.

-

-

For the second child:

-

New maximum possible deduction: 12 months x €100/month = €1,200.

-

Annual contribution limit: €1,360.

-

New amount of maternity deduction = €1,200.

-

Amount of deduction applied in 2020: €300.

-

Extension of the 2020 maternity deduction to be received in 2022 income for the second child: 1,200 – 300 = €900.

-

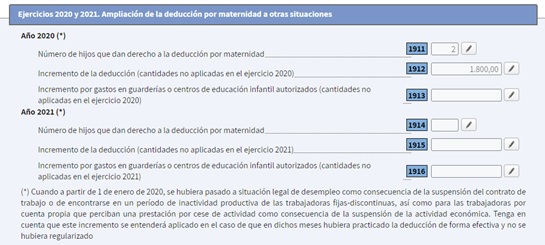

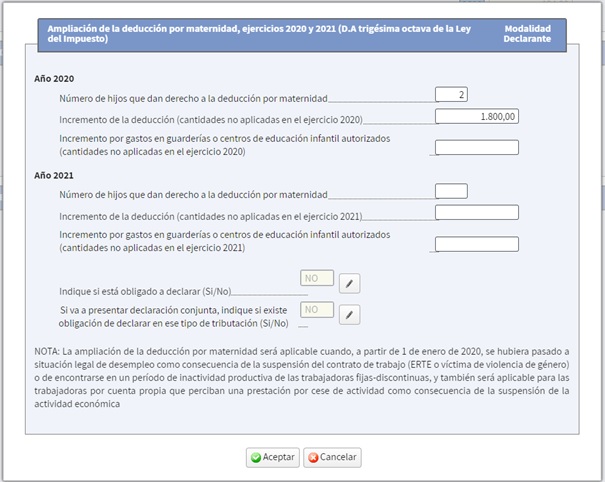

The sum of both amounts (900 + 900 = €1,800) is what must appear in box 1912 of the 2022 Income Tax return “ Increase in the deduction (amounts not applied in fiscal year 2020)”:

And inside the box:

-

Number of children: 2.

-

Increase in the deduction (amounts not applied in fiscal year 2020): €1,800.

-