Example of obtaining calculation data

During 2020, a taxpayer worked from January 8 to June 4 and from September 27 until the end of the year. From June 5 to September 26, he was in a total suspension ERTE collecting unemployment benefits

Has a son born on 07/27/2019. This son went to daycare in the months of January, February, October, November and December.

In her 2020 Income Tax return, the taxpayer applied the maximum amount that corresponded to her for the maternity deduction and the increase for childcare expenses in accordance with the regulations in force at that time.

Solution:

It will be necessary to consult:

-

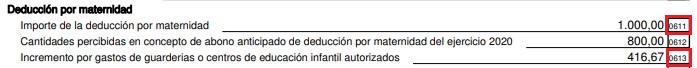

The amount reflected in boxes 611 and 613 of the 2020 Income Tax Return applied for these concepts:

-

The amount of annual contributions to Social Security: having a child under 3 years old during the year 2020, which amounts to a total of €7,070.71.

In the tax data, you can consult the total amount contributed in the “Maternity deduction” section:

-

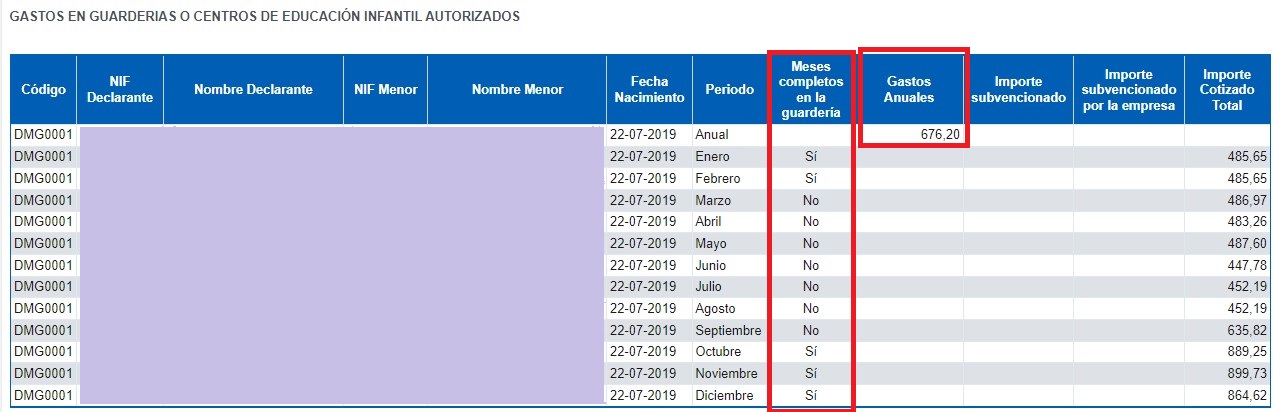

The amount paid to the nursery (€676.20) and the full months in which the child attends (January and February and from October to December):

This information can be found in the tax data for each year for each of the children in the section “Expenses on authorized nurseries or early childhood education centers.”

-

Extension of the maternity deduction 2020 :

In the 2020 Income Tax Return, she recorded the maternity deduction for an amount of €1,000 (box 0611) for the 10 months of the year in which she carried out an activity for which she was registered with Social Security (it is enough that she worked one day in the month for that month to be able to apply the maternity deduction).

With the extension of the maternity deduction to the new circumstances that include the case of self-employed workers who become legally unemployed due to their employment contract being suspended in the case of ERTE with total suspension, in the 2022 Income Tax return they will be able to include the deduction for the rest of the months of 2020 for which they are now entitled, that is, July and August in which they did not work.

In this way, instead of 10 months, you will be entitled to 12:

-

New maximum possible deduction: 10 months x €100/month = €1,200.

-

Annual contribution limit: 7.070,71€. The limit does not operate.

-

New amount of maternity deduction = €1,200.

-

Amount of deduction applied in 2020: 1,000 €.

-

Extension of the 2020 maternity deduction to be received in Income Tax 2022: 1,200 – 1,000 = €200.

-

-

Extension of the increase for childcare expenses 2020:

In 2020, the son attended daycare for five full months (January and February and from October to December) and the deduction was applied for these five months.

Since the maximum amount to which you are entitled in Income Tax 2020 has already been applied, no amount has to be reflected in Income Tax 2022.

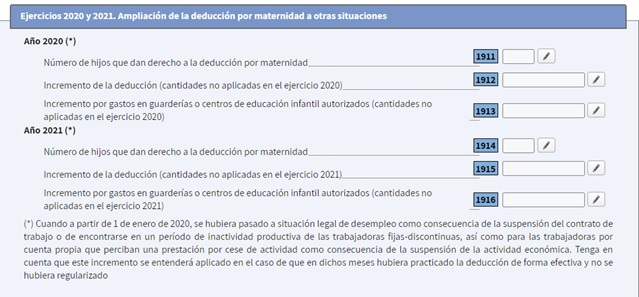

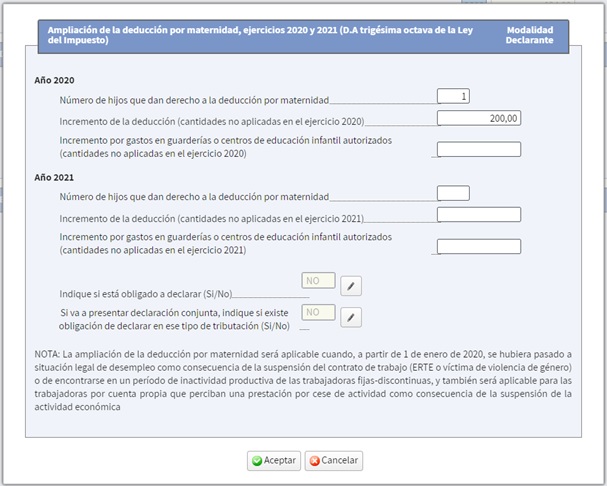

Once the amount of the extension has been calculated, boxes 1911 and 1912 will be completed in Renta Web.

By clicking on any of them:

Furthermore, if in accordance with the provisions of article 96 LIRPF there is no obligation to declare in 2022 and the only reason for filing the 2022 Income Tax Return is to apply the maternity deduction or the increase in childcare expenses for 2020 and/or 2021, this circumstance will be indicated on this same screen in the boxes: