How to get the data for the calculation

- Data required for calculation.

To calculate the amount of the extension of the maternity deduction and the increase for childcare expenses, it will be necessary to know for each of the children who may be entitled to it:

- Your date of birth:

- The maternity deduction will apply as long as the child is under 3 years old (therefore, the month of birth is counted and the month in which the child turns 3 is not).

- The increase in the deduction for childcare expenses will apply up to and including August of the year in which the child turns 3 years old.

-

The amounts of the maternity deduction and the increase for childcare expenses applied in the 2020 and 2021 Income Tax returns.

2.1 If you filed a return:

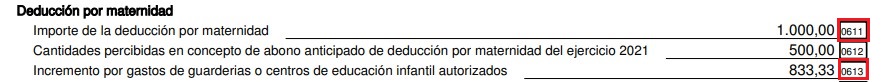

These amounts can be consulted in the Income Tax returns for each of the fiscal years and will appear in the boxes:

- Box 0611: Amount of the deduction.

- Box 0612: Increase for expenses in authorized nurseries or early childhood education centers.

2.2. If you did not file a return:

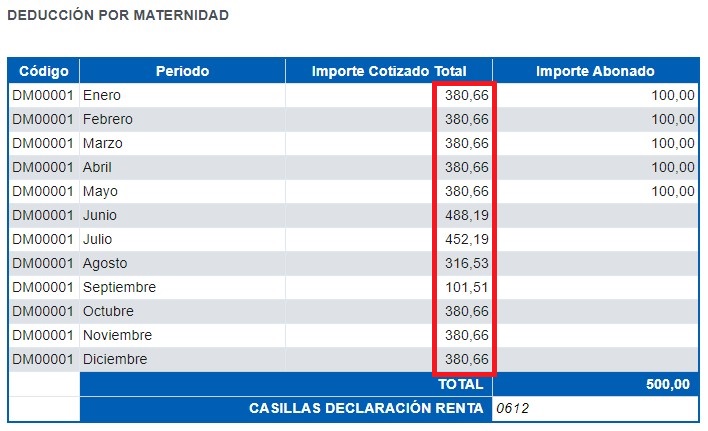

In this case, only the advance payment of the maternity deduction may have been obtained. The amount can be found in the tax data for each of these years in the “Maternity deduction” section.

For non-filers, this will be the amount of the maternity deduction obtained in the year.

- The amount of monthly contributions to Social Security.

In the tax data for each of these years, the itemized amount of monthly contributions can be consulted in the “Maternity deduction” section:

For the maternity deduction, contributions from all months in which the child is under 3 years old will be taken into account, taking into account:

-

In the year of birth of the minor, the calculations will be made from the month of birth included.

-

In the year in which the minor turns 3, contributions will be computed for all months up to the previous month in which he or she turns 3.

To increase the deduction for childcare expenses, the following contributions will be taken into account:

-

In the year of birth of the minor, the calculations will be made from the month of birth included.

-

In subsequent years, the total amount of annual contributions will be taken.

-

However, in the year in which the employee turns 3, contributions will be computed up to and including the month of August, regardless of the date on which the employee turns 3.

-

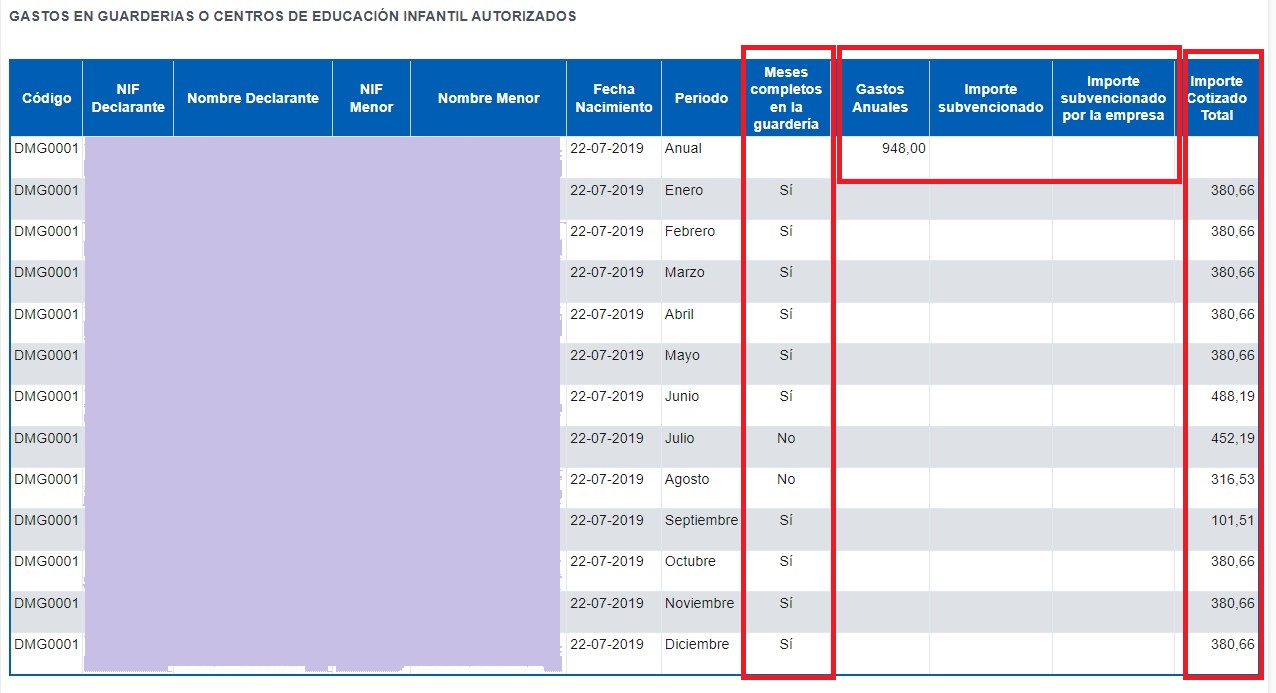

- The amount paid to the nursery.

This information can be found in the tax data for each year for each of the children in the section “Expenses on authorized nurseries or early childhood education centers.” The information regarding the amounts subsidized, the full months in which the child has attended daycare and the amount of Social Security contributions will also appear (which also appear in the section on tax data regarding the maternity deduction seen above).

Please note that the following contributions will be taken into account to increase the deduction for childcare expenses:

In the year of birth of the minor, the calculations will be made from the month of birth included.

In subsequent years, the total amount of annual contributions will be taken.

However, in the year in which the employee turns 3, contributions will be computed up to and including the month of August, regardless of the date on which the employee turns 3.

Once the amount of the extension has been calculated, boxes 1911 to 1916 will be completed in Renta Web.

- Your date of birth:

- Where to consult tax data:

You can consult the tax data by accessing the section Personal Income Tax / How do I have to file my declaration / How to consult my tax data or by clicking directly on the following link Tax Agency: How to consult my tax data