Information on the box from the previous year’s Renta return

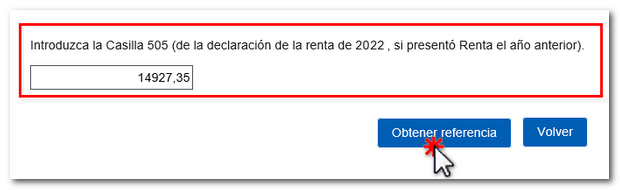

To request the Income Tax return reference, you must provide the amount from box 505 of the submitted 2023 Income Tax return.

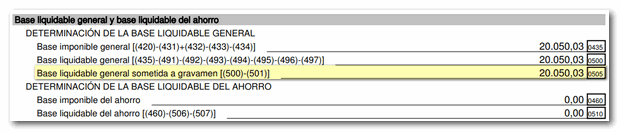

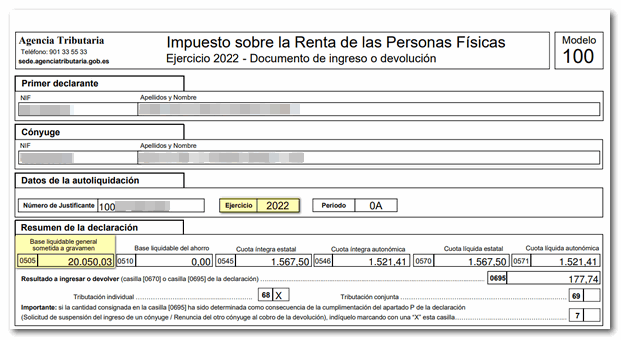

Box 505 of the 2023 Income Tax Return corresponds to "General taxable base subject to tax" and not to any other amount or to the result of the return.

You can confirm the amount in box 505 of your tax return copy in the section “General net tax base and Savings net tax base”, or in the payment or refund document.

If you did not file a IRPF return for the 2023 financial year, or if the amount is 0.00, you must provide the last five digits of the IBAN code of a bank account in which you are listed as the holder.

If you have questions about how to access your confirmed draft or filed 2023 Income Tax return, we recommend following the steps detailed in the "How to obtain a copy of your 2023 Income Tax return" help section in the "Income Tax - Technical Help" section.

Remember that you must provide the amount corresponding to the tax return that was finally filed; if the Administration has carried out a subsequent settlement, you must provide the corresponding information from box 505.

If an error appears regarding the box format, we remind you that in the field for box 505 you must enter the whole number without any sign, separated by a comma (,) from the decimals , for example 12006.63.

If you are unable to locate the correct amount in box 505 of the tax return filed for the 2023 tax year to request the draft reference, the following options are available:

-

Access the Income services through Cl@ve . It is an identification system that allows you to carry out procedures online based on agreed-upon keys with a limited validity period and that can be renewed whenever necessary. The system allows users to scan a QR code, which prevents the user from having to enter their identification data on the access screen. If you cannot scan the QR code, you can continue with the authentication by entering your DNI or NIE details plus the verification data or request a PIN that you will receive via SMS on your mobile phone. For more information, see the related help.

-

Have electronic certificate or eDNI . For more information on how to obtain an electronic certificate, see the related help.

-

Request an appointment at your local government office to receive your 2024 Income Tax reference number. It will be available starting March 12th and will be available in-office on March 13th. You will be able to access this service until June 30, 2025 (end of the campaign period).