FAQs

Skip information indexCommon Questions: new service on the Pre303. Importation of books in computer format. Pre303/LSI

In April 2022, a new version of the help service for filling out the aforementioned form was made available to VAT taxpayers who are required to submit Form 303. This service is available to taxpayers who keep their registration books on computer media.

This new service involves the automatic completion of settlement data and additional information for taxpayers who are not in SII and who keep their books on computer media according to the format established by the Tax Agency.

The new Pre303 service will be available and can be used to file the self-assessment for the first quarter of 2022 and subsequent years.

Since 2022, the Pre303/LSI service is offered to taxpayers who submit form 303, keep their registration books in electronic format, and have a quarterly periodicity with the exception of those who are included

- in SII

- under simplified VAT regime

- in gold investment regime

Through the form that appears in the Electronic Office for the presentation of model 303

Tax Agency: PRE 303 (Assistance Form 303)

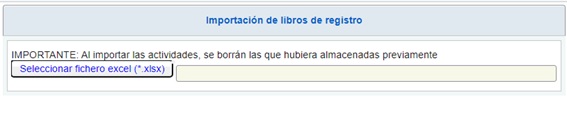

The taxpayer has access to import books from the Liquidation section

The taxpayer must keep the books in computer format according to the format published by the Tax Agency so that the system can calculate the amounts to be included in each box.

The registration books must be in the Excel format available at: LSI

If you do not have a computer application to generate them, you can create them using the following template:

When the taxpayer enters to fill out the model through the form, upon reaching the settlement page he must click on the Registration Books button

The system asks the taxpayer to identify his Excel file that contains the taxpayer's books for his economic activity(ies).

The book is unique for the entire financial year, so the data from all periods of the same year are recorded in the same file.

That is, when completing 1Q/303 the book has data from invoices registered in 1Q, when completing 2Q/303 the book has data from the 1Q already submitted and from the 2Q to be prepared and submitted after import, when completing 3Q/303 the book has data from the 1Q and 2Q already submitted and from the 3Q to be prepared and submitted after import and finally in 4Q the book contains invoices for the entire year, without prejudice to the fact that upon import the corresponding quarter is completed according to the period, that is, in this case 4Q/303.

The information contained in the imported VAT Record Books will be kept in the Tax Agency systems and, if you have opted for joint keeping, you will be able to reuse them when submitting forms 100 and 130. .

Importing a new Logbook will delete the information that currently exists in the form. Once the self-assessment has been submitted, the Registration Book can be imported again to submit a supplementary return.

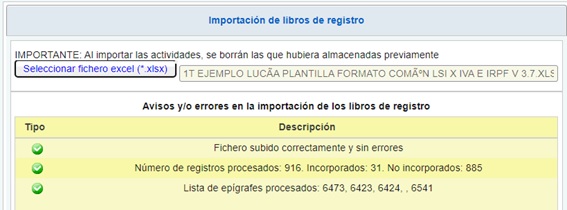

It will be possible to see if there has been any incident in the import so that the taxpayer can proceed to correct it.

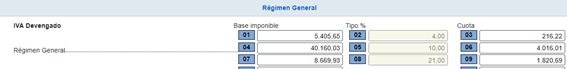

So when the taxpayer returns to model 303, he finds the boxes filled in according to the data recorded in the books.

The economic data contained in the Pre303 derived from the import of books cannot be modified by the taxpayer. If it is necessary to change or adjust any data, the record in the file must be rectified and imported again to adapt the amounts to the reality of its economic activity.

Regarding the census data related to the tax, which the taxpayer views in the VAT Census Window and in the identification data section, they will always be modifiable through access to My VAT Census Data so that have an effect on the census.

The "Transaction Date" column in the Issued Invoices Record Book must be filled in when the transaction date is different to the invoice issue date.

The "Transaction Date" column in the Issued Invoices Record Book must be filled in when the transaction date is different to the invoice issue date and this is stated in the same.

Example: Company A sells goods to another company on March 20, 20XX, documenting the transaction in an invoice dated April 10, 20XX. Do I have to record both dates?

The “Invoice issue date” (April 10, 20XX) and the “Operation date” (March 20, 20XX) will be recorded and the fiscal year 20XX period 1Q will be identified.

The date of the transaction corresponding to the original invoice that is subject to rectification.

The last day on which the transaction documented in the last rectified invoice was carried out will be reported (the most recent date).

Enter the date of the most recent operation documented in the summary invoice.

Example: invoice issued on 25 July 20XX documenting various deliveries of goods made on 1, 10, 15 and 20 July 20XX; the transaction date is 20 July.

They will be identified with NIF (except in the case of foreigners).

In the case of the Register of Invoices Issued, when it concerns simplified invoices in which the client has not been identified, the NIF may come without content, but in such case in the "Recipient Name" column the SALE PER BOX will be recorded.

When the client or supplier does not have NIF assigned in Spain, the identification number assigned by their country will be recorded with a maximum of 20 alphanumeric characters.

The types of ID in the country of residence and their corresponding values are:

02: NIF-VAT

03: Passport

04: Official ID issued by the country or territory of residence

05: Residence certificate

06: Other documentary proof

In the column "Country Code" enter the country code of the client or supplier, according to the ISP 3166-1 alpha 2 code. It will not be mandatory if the identification type is 02.

Where the address of the customer/supplier corresponds to a non-EU country, or in the case of an EU country, where the declared party does not have an Intra-Community Operator Number (as is the case for some EU end-consumers) It will not be mandatory if the identification type is 02.

When a material error has occurred in the invoice (the invoice does not meet any of the requirements established in article 6 or 7 of the Invoicing Regulations), a well-founded error of law, an incorrect determination of the passed-on rate or any of the circumstances that give rise to the modification of the taxable base (art. 80 LIVA) a corrective invoice must be issued, which will have a special series.

The issuance of the rectification invoice can be made by replacement or differences.

- When the correction is made by “replacement” the correction made must be reported, also indicating the amount of said correction.

- When the correction is made for “differences” the amount of the correction must be reported directly, regardless of its sign.

Example: an invoice with a taxable base of €1,000 and a quota of €210 should be corrected by €800 and €168 respectively):

- Replacement: 2 invoices must be registered, the erroneous one with negative amounts and the rectification invoice (one invoice with taxable base €-1.000 and tax liability €-210, another rectification invoice with taxable base €800 and tax liability €168).

- Due to a difference 1 invoice should be registered in which the rectified amount is directly reported (an invoice with taxable base €-200 and quota €-42).

In accordance with the last paragraph of article 63.4 of Royal Decree 1624/1992 ("The entry of the same invoice in several correlative entries will also be valid when it includes operations that are taxed at different tax rates"), if an invoice contains data at different rates of VAT/Equivalence surcharge, a line will be included for each type, breaking down the amounts corresponding to the tax base, passed-on or borne fee, equivalence surcharge fee and collections/payments in the case of cash-based operation, repeating the rest of the common data ("Issue Date", "Operation Date", Invoice Identification, Reception Number in the case of the Record Book of received invoices, “Recipient NIF” / “Sender NIF”, “Recipient/Sender Name”, “Type Invoice" and "Operation Code").

The "Total Invoice", although unique to the invoice, is not considered to be common to all lines of the invoice. In the case of multi-line invoices, each line should be treated as one entry, so that when the total amount is reported, it should be the amount corresponding to each entry, which in the case of multi-line invoices will be the total amount of each line.

That is, in the case of multi-line invoices, the "Invoice Total" column of each line must contain the subtotal of that line:

"Total Invoice" = "Taxable Base" + "Input VAT Quota" + "Eq. Surcharge Quota".

Example: invoice issued on 25 April, with a taxable base of 10,000 euros, applying a rate of 10% to 2,000 euros and the rest at 21% (in the example, only the columns with content are shown).

|

Date of issue |

Identification of the invoice- Number |

Recipient ID |

Recipient Name |

Total invoice |

Taxable base |

VAT Rate |

VAT amount affected |

|---|---|---|---|---|---|---|---|

|

25/04/20XX |

10 |

AXXXXXXXX |

Company A |

2200.00 |

2000.00 |

10.00 |

200.00 |

|

25/04/20XX |

10 |

AXXXXXXXX |

Company A |

9680.00 |

8000.00 |

21.00 |

1680.00 |

Similarly, in the columns "Eligible Income" and "Deductible Expense" the subtotal of each line shall be entered, so that the accumulation of the data entered in these columns is the total amount of the eligible income or deductible expense of the invoice; it is, in short, equivalent to if it had been recorded only once.

In the case of a transaction subject to the Cash Basis Special System, the columns "Financial Year" and "Period" shall not be considered as common data and in each line the value corresponding to the "Date" of Collection/Payment of each line shall be entered.

Yes. In the section that identifies the invoice, the series and number of the first and latest invoice should be entered.

Yes. It will be recorded with a line for each type, breaking down the amounts as indicated in the question “How do I record an invoice issued or received that includes several tax rates?”

If, after a simplified invoice has been issued and registered, a full invoice must be issued to replace it, either of the following two forms of registration are permitted:

- Double entry:

- A negative entry in the simplified invoice and

- Entry in the full invoice that replaces it.

- Make a single entry of the complete invoice, entering the value “F3” in the “Invoice Type” field, which means that the VAT charged on this invoice is not accumulated to the VAT accrued. In other words, a substitute invoice is recorded without a negative account entry that cancels out the simplified invoices it replaces.

Yes, when the joint maintenance of the VAT and IRPF Registry Books has been chosen. The new design of the standardized electronic format (Common Format LSI x VAT and Personal Income Tax v 3.X.xlsx) allows the joint maintenance of the VAT and Personal Income Tax Record Books.

The invoice record documenting these operations must include the fee charged separately. Operation key 03 05 09 as appropriate.

Consequently, in the Register of Invoices Issued when it comes to taxable and non-exempt operations, the “Total invoice” must be recorded, completing the corresponding data of taxable base (margin in code 03 05), type and rate.

In the Record Book of Incoming Invoices, the tax base, rate and quota will be recorded with the corresponding amounts and the total consideration will be recorded as “Total invoice”. The "Amount deductible" will be zero.

Among the objectives pursued by Order HAC /773/2019, of June 28, which regulates the keeping of registration books in the Personal Income Tax, is to reinforce and specify the possibility that these books can be compatible, with the necessary additions, as a tax book for taxes that so provide.

Specifically, as indicated in Article 12 of the aforementioned Order, the Personal Income Tax records may be compatible with those required for Value Added Tax under the terms of Article 62.3 of the Value Added Tax Regulations.

Therefore, joint bookkeeping does not have additional requirements to those of separate bookkeeping, but is an objective pursued with the aim of reducing the formal obligations of the group of taxpayers obliged to keep records of their economic activities. And provide them with a simple and effective support system in completing the models, both for indirect taxes (303) and direct taxes (130,100) related to books.

The withholding of IRPF affects the amount of the payment or collection, but does not affect the “Total Invoice”. Thus, in an invoice issued, the amount of the column "Invoice total" will coincide with the sum of the columns corresponding to "Taxable base" plus the "Recovered VAT quota" and "Equivalence Surcharge quota". In the cases of remuneration for a professional activity provided for in Article 95 of the Personal Income Tax Regulations, withholding shall also be made from the full income paid in accordance with the provisions of said article, which shall be shown in the columns "Personal Income Tax Withholding Rate" and "Personal Income Tax Withholding Amount".

For example, if an invoice is issued for €200 of tax base with VAT at 21% and personal income tax withholding at 15%, what will be the “Total Invoice”?

|

Date of issue |

Invoice identification-Number |

Invoice Total |

Taxable base |

VAT Rate |

VAT Amount Affected............................................................................. |

Personal income tax withholding rate |

Amount withheld for personal income tax |

|---|---|---|---|---|---|---|---|

|

25/04/20XX |

10 |

242 |

200 |

21 |

42 |

15 |

30 |

Then the "Total Invoice" will be €242, although the recipient of the invoice has to pay €30 to the Tax Agency for personal income tax withholdings on behalf of the sender of the invoice and has to pay €212.

Yes, because the layout is unique for the two Register Books, and, if the column does not apply, it will be left without content, but respecting the column.

If you choose to keep unified books for both taxes, in any case all columns must be completed (as appropriate to the data to be recorded).

If you choose to keep separate returns, the columns exclusive to the other tax will be left blank and all the others will be completed.

The columns exclusive to IRPF are Income Concept, Computable Income, IRPF Withholding Type and IRPF Withheld Amount in the income/invoices issued register book and Expense Concept, Computable Expense, IRPF Withholding Type and IRPF Withheld Amount in the expenses/invoices received book.

Yes, the new design can be used for earlier periods (backwards compatible).

To know how to record the new columns in previous fiscal years, it must be taken into account that the content changes introduced by the new design of the electronic format of the registration books are the following:

- New exclusive fields for VAT aimed at the automatic preparation of model 303 by importing VAT registration books.

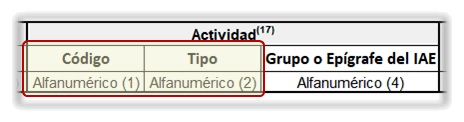

- New common fields, including the modification of the identification of the Economic Activity carried out aimed at standardizing the coding of the classification of economic activities, which had been different between different models. This will also imply a gradual implementation of this standardized coding in both the VAT, Personal Income Tax and Census models.

For Personal Income Tax, the columns corresponding to the new VAT-only fields can be left empty. But the columns "Code" and "Type" of Activity common to VAT and Personal Income Tax. They must be recorded in accordance with the corresponding validation;

At least one entry for the change in stock must be made at the end of the fiscal year (final stock) with respect to the first day of the year (initial stock) to the concept of the corresponding Registration Book according to the change:

-

Increase: Entry in the Sales and Income Record Book with the concept “I06” (Variation in stock - increase in final stock).

-

Decrease: Entry in the Purchase and Expenses Record Book with the concept “G02” (Variation in stock - decrease in final stock)

Taking into account that the VAT rate for this entry must be 0.00.

For the purposes of calculating the quarterly fractional payment of personal income tax, the taxpayer may choose to make a variation entry at the end of each quarter with respect to the first day of the quarter.