The impact of the DANA on economic and revenue figures

The impact of the catastrophe caused by the DANA on the evolution of economic and tax figures is obviously not the most important issue in this tragedy, but it has occupied a prominent place from the first days.

The media immediately began to publish the first assessments of the effect this could have on GDP or the impact the flood had had on the use of payment methods, an indicator that, because it is so readily available to analysts, is quickly used to illustrate any change in the behaviour of companies and consumers.

The truth is that any economic evaluation of an impact can only be an approximation of the real effect, an approximation subject to the discretion of the assumptions used in the estimate. In the case of the impact on tax revenues, there are also the complexities of the collection system itself and the peculiarities of the measures adopted to mitigate the damage.

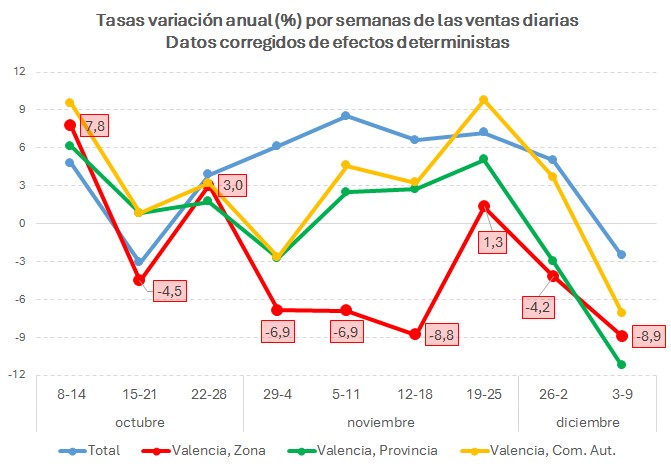

With the daily information available through the Immediate Information System ( SII ), you can obtain the trend that sales have followed weekly since October 28 (the last week still with incomplete figures). The following chart contains this data for different company aggregations:

The graph compares the evolution of all companies (in blue; is the usual reference figure in weekly sales reports), together with the behaviour of the SII companies domiciled in the Valencian Community (yellow), in the province of Valencia (green) and in the Valencian municipalities directly affected by the DANA (red). Is the impact on domestic sales simply the decline in sales in the municipalities in the destroyed area? Obviously not, it is not even a good measure of the sales lost by those companies. To get a better idea, we need to make assumptions about what the growth of these companies would have been had the tragedy not occurred. This is where the discretion of analysts comes into play.

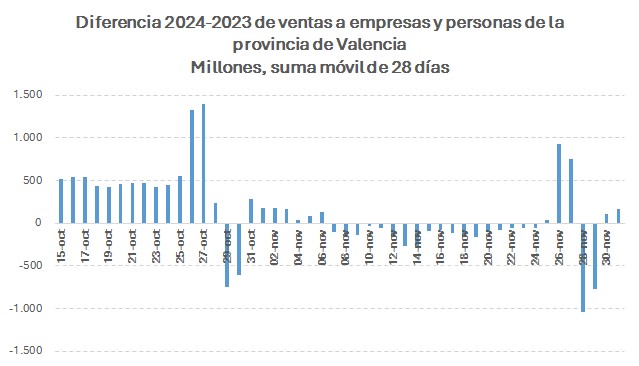

The same problem arises when we focus not only on what these companies sell, but also on what all residents, businesses and families in the province of Valencia buy. The following table shows the evolution of these purchases.

The chart shows the difference in sales on the same days in 2024 and 2023, in a 28-day rolling sum to smooth out the irregularity of the series. As expected, the impact was immediate, but again we have to ask ourselves: Is this the true measure of effect? The answer is the same; we would have to assume an alternative situation without impact with which to compare in order to be able to approximate the real impact.

As noted, the situation is even more complex when it comes to assessing the impact on tax collection. In addition to the difficulties associated with the effect on economic variables, it is necessary to take into account the deadlines in which taxes are paid and the measures implemented to facilitate compliance with the tax obligations of those affected.

Regarding the first, in November the main models that should have been presented are the monthly models corresponding to October (basically, for Large Companies) for withholdings on work income and VAT, in addition to the payment of the second installment of the positive quota of the 2023 personal income tax return. Only the latter has had an impact on November's collection (see Monthly Tax Collection Report ) due to its transfer, for taxpayers in the province of Valencia, to the end of February. There is no significant change in the withholdings from work and VAT, with the deadline being October 30, will appear in the December collection. The tax and VAT withholding forms that SMEs have to submit are quarterly, so the impact on these companies will be seen in the fourth quarter declarations to be submitted between January and February. This is when the effect of lower activity on income will be observed.

As regards the measures that have an impact on revenue, it should be noted that most of them involve a delay in tax collection. The effect this will have on revenue will be a lower initial amount offset by a higher amount a few months later. In the case already observed of the second installment of the positive IRPF rate, the lower collection in October will be offset by a higher collection in February. The same will happen with other cases, such as the third instalment of corporate tax for companies domiciled in the affected area (which will be seen in 2025 and not in December 2024, which would have been normal) or with those obligations for which taxpayers have taken advantage of the deferral facilities.