How to answer requests, make allegations and/or provide documents or supporting tax certifications

Access requires identification with Cl@ve , certificate or electronic DNI . Fill in the required fields and specify whether the submission is on your own behalf or on behalf of third parties.

Once you have completed the file number, go to the following box. If the data is incorrect, a pop-up window will warn you of this fact. Remember that you can find the file/reference number both on the certification application receipt and on the tax certification itself.

If the file number is correct, the interested party's NIF will then be validated to ensure that it corresponds to the file number.

By default, the "On your own behalf" presentation option will be checked. Therefore, if you are accessing as a collaborator or representative, a pop-up window will indicate that the interested party is not the same as the one that appears in the tax certificate request. Accept the notice, select the "On behalf of third parties" box and indicate the NIF of the interested party.

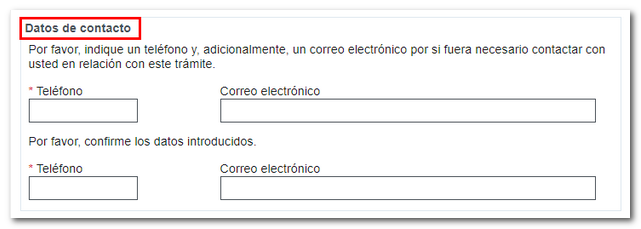

Next, you will need to provide your contact details. Please provide a contact telephone number and, additionally, an email address in case it is necessary to contact you.

Additionally, you can attach documentation from the "Add files" option. When you click on it, the window for selecting the files to attach to the reply will appear. Click "Select Files" to access the file explorer and choose the file you need to attach. Please note that the file cannot exceed 64 Mb and must be in an accepted format. You can get more information on accepted file formats in the "Help" section.

Once the required fields have been completed and the necessary documents provided, click on "Submit".

If the submission is correct, you will receive the receipt of the submission with the data of the registry entry, the procedure, the interested party, the list of attached files and the CSV assigned to the submission so that the recipient can verify its authenticity and validity.