Newsletter subscription

Skip information indexConsult information notices

You can consult your data communicated to the AEAT for the reception of informative notices from the service "Consultation of informative notices" .

You have several alternatives to access this consultation service, if you are a natural person:

- With certificate or electronic ID

- With Cl@ve

- With the Income reference that you have obtained on the website or in the APP

If it is a legal person or an entity without legal personality, a representative certificate is required to access the notification consultation procedure.

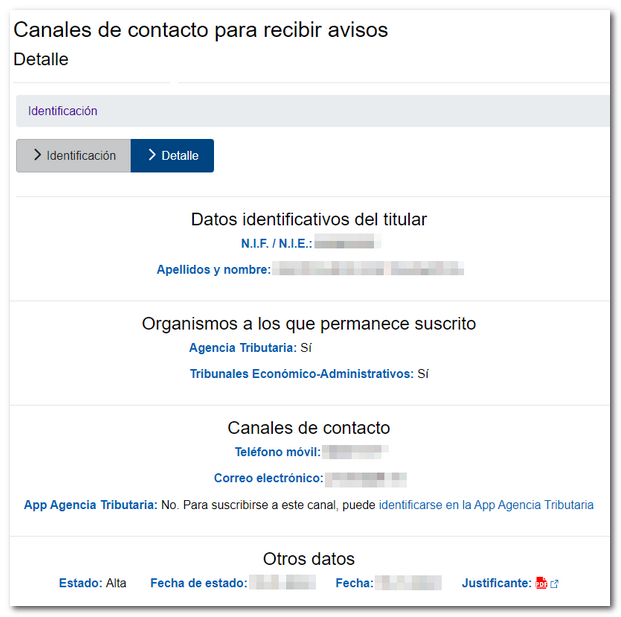

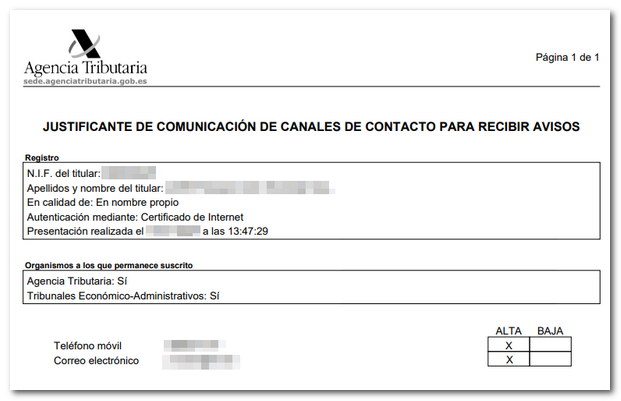

From here you can check the agencies to which you remain subscribed, "Tax Agency", "Economic-Administrative Courts" and "General Directorate of Taxes", and you will verify the mobile phone number and email address registered for receiving alerts and push notifications. You can also consult the proof of the last movement made in PDF format from the "Proof" option.