Deduction for purchasing electric vehicles and installing charging points

Find out how you can deduct from your Income Tax the amounts paid for the purchase of plug-in electric and fuel cell vehicles and for the installation of charging points.

Deduction for the acquisition of plug-in electric and fuel cell vehicles

If you wish to obtain information about this deduction, you can access Tax Agency: Deduction for the acquisition of "plug-in" electric vehicles - Right to the deduction

COMPLETING BOXES ON RENTA WEB

It will be done from the following screen:

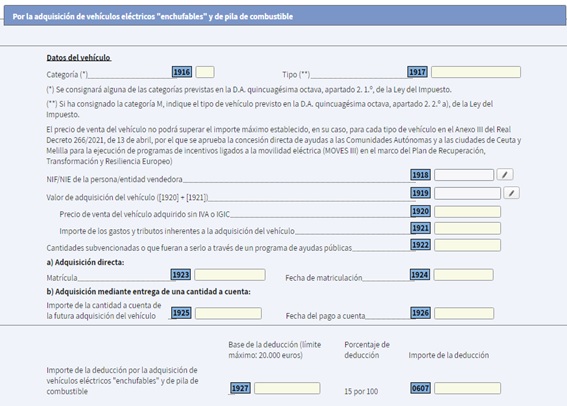

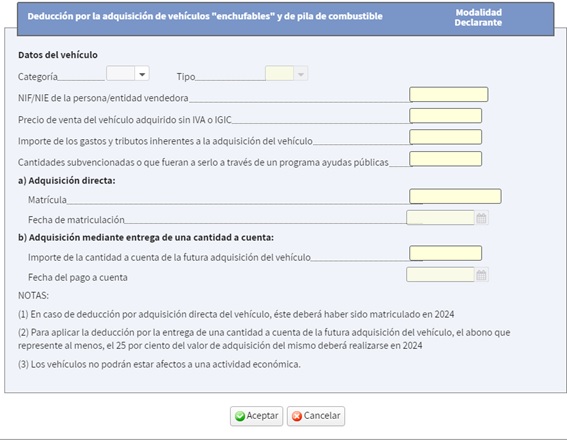

Clicking on the marked boxes will open the following window:

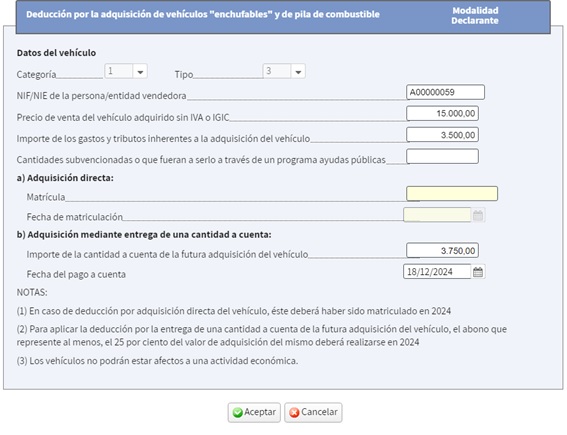

Where the necessary data will be completed for the calculation of the deduction:

-

Vehicle data:

-

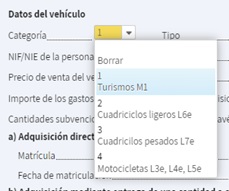

In “Category” the corresponding one will be selected from the drop-down menu:

-

-

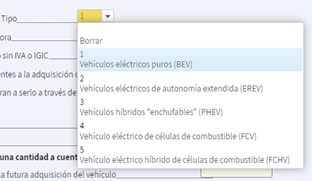

In “Type”, the vehicle will be selected from those listed in the drop-down menu:

-

NIF/NIE of the selling person/entity.

-

Vehicle sale price: Neither VAT/IGIC nor other expenses associated with the purchase are included.

-

Amount of expenses and taxes: includes VAT or IGIC, registration tax, etc.

-

Amounts subsidized or that would be subsidized through a public aid program: The amounts requested are included, even if they have not yet been received.

-

In relation to the acquisition method it will be necessary to complete one of the following sections:

-

If the acquisition was made in 2024: The vehicle registration number and registration date will be indicated.

-

If the purchase is made by means of a down payment, the amount of said amount and the date of payment will be recorded.

-

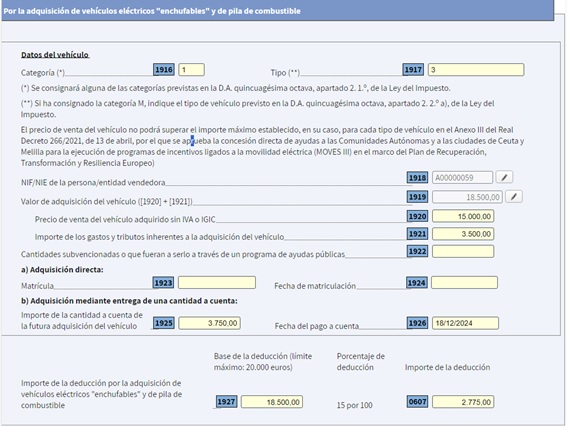

Example of completion in the event that the vehicle is acquired by paying an amount on account:

Since in this case the amount of €3,750 is at least 25% of the purchase price of the vehicle (sale price without expenses and taxes), clicking on “Accept” will display the amount of the deduction calculated on the sale price plus expenses: (15,000 + 3,500) x 15% = €2,775: