Deduction for purchasing electric vehicles and installing charging points

Find out how you can deduct from your Income Tax the amounts paid for the purchase of plug-in electric and fuel cell vehicles and for the installation of charging points.

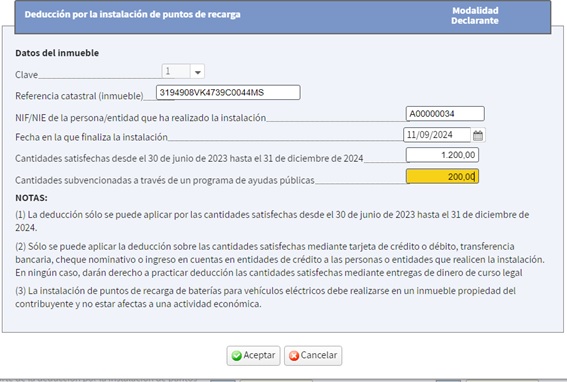

Deduction for the installation of charging points

If you want to obtain information about this deduction, you can access Tax Agency: Deduction in personal income tax for the acquisition of plug-in electric and fuel cell vehicles...

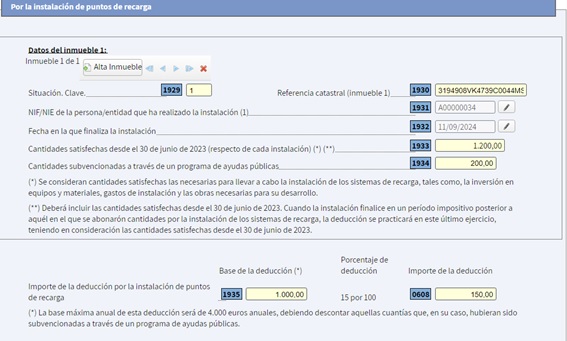

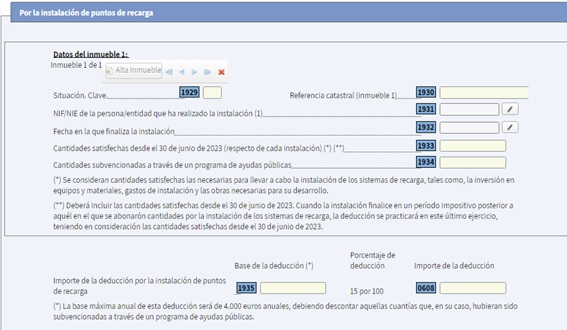

COMPLETING BOXES ON RENTA WEB

It will be done from the following screen:

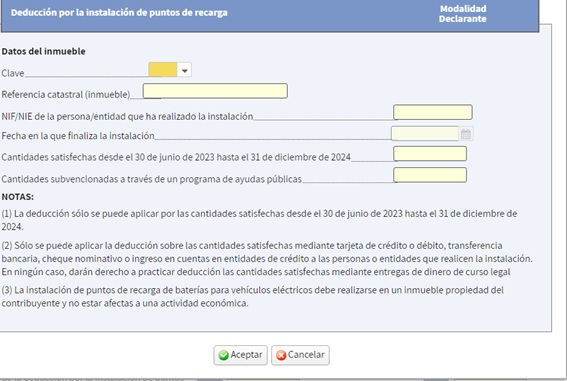

Clicking on the marked boxes will open the following window:

Where the necessary data will be completed for the calculation of the deduction:

-

Property details:

-

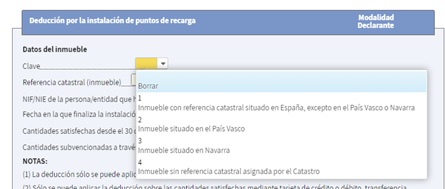

In “Key” the corresponding one will be selected from the drop-down menu:

-

If you have selected any of the keys 1 to 3, the property's cadastral reference will be filled in.

-

-

Installation data: NIF of the installer and date on which it was completed.

-

Quantities satisfied.

-

Subsidized amounts: Only amounts already granted will be included.

Instruction on how to fill out the form:

And after clicking “Accept” the amount of the deduction will be displayed: 1,000 x 15% = €150.