Form 390 - Technical assistance

Skip information indexForm 390. Filing by form

Using the web form "Model 390. VAT Annual Summary Declaration" you can complete and submit the declaration electronically.

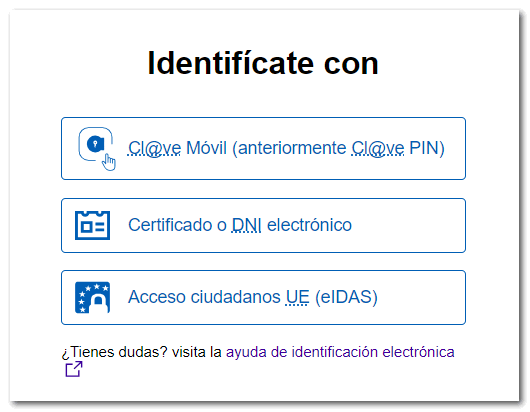

How can you identify yourself?

- With certificate or DNI electronic

- With Cl@ve (only natural persons)

- Access to citizens of the EU( eIDAS )

Types of representation

- On behalf of (declarant/holder of the declaration)

- On behalf of third parties: through social collaboration , empowerment or succession

In the initial window, fill in the NIF , name and surname or company name and click "Accept".

Note: The NIF cannot be modified later (to change it, it will be necessary to generate a new declaration, starting the completion from the beginning).

A notice will be displayed informing you of the cases in which you are not required to submit Form 390.

Next, depending on the status of the declaration, you will have four options:

- "New declaration" to access the form and complete the declaration from the beginning.

- "Continue" to load the data stored on the AEAT servers that were saved in a previous session

- "Modify declaration" It will only appear when a declaration for the same fiscal year has been previously submitted. Allows you to load the data for said declaration and make modifications

Access the different pages of the declaration from the "Sections" index or use the navigation arrows.

If you have any questions about completing the form, go to the option " ADI Do you need help?" in the bottom right corner to link to available tax information and support services.

You also have a box search engine, both by box number and by concept, using the magnifying glass icon located between the "Sections" and "Preview" buttons. Once you have obtained the search, select the page and press the "Go to page" button.

Using the "Save" button you can save the data on the AEAT servers, so that you can recover them in a later session. Please note that if a previously recorded statement already exists, it will be overwritten.

Check for errors by clicking the "Validate" option in the top menu.

Any detected warnings or errors will be displayed. Notices are for informational purposes only and do not impede submission. Errors must be corrected in order to file the return.

The "Go to error" and "Go to notice" buttons direct you to the box or page that needs to be reviewed or corrected.

If the statement contains no errors you will get the message "No errors exist".

At any time you can preview the declaration in PDF , not valid for filing and save it using the option "You can click here to download the pdf ". For correct viewing of the draft you need a PDF viewer.

Click "Back to return" or start a "New return".

If there are no errors, press "File Return" to file the return. In the next window, check the box "Compliant" and, again, "Submit Declaration" .

If the submission is correct, you will get a response page with the Secure Verification Code ( CSV ) and the PDF of the submitted return.