Models from 199 to 289

Skip information indexModel 236

The presentation of form 236, as well as modifications and cancellations, can be done through the web service or through the form at the Headquarters.

Access to this procedure may be carried out with an electronic certificate or electronic DNI and, if the taxpayer is a natural person, also with Cl@ve .

In addition to the holder of the declaration, the submission may be made by a third party acting on his or her behalf, whether a corporate collaborator or an agent.

After identification, the system will ask you if you are going to act on your own behalf or on behalf of third parties.

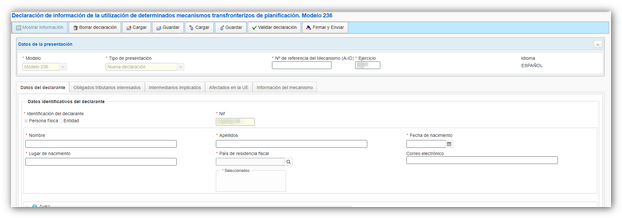

Fill in the data on the different tabs of the model.

In some sections you will find a button bar to add new records, delete them, access the details of each one to modify them, if you consider it appropriate. You have the "New record" button to create a new one and the "Import" buttons to import a file from your database and "View details" to access a specific record.

At the top of the form you have the actions allowed for the model. The "Save and Load" buttons shown in the image allow you to save a file with a .ses extension that will be downloaded to the default location on the computer and then uploaded and continue with the completion or submission of the model.

The other options " Save and Load " allow you to store the data completed up to that point on the AEAT servers, even if it is not validated (it may contain errors or be incomplete)

If a tax return has been saved previously, it will be overwritten.

When you click on "Load", if there is a declaration saved for that NIF the server will detect it and give you the option to recover it.

Once you have finished filling out the different tabs and sections of the form, press "Validate declaration" and the program will tell you whether or not there are errors.

If there are errors or warnings, you can access their details by clicking "Go to error" or "Go to warning".

Once the declaration has been validated without errors, press "Sign and Send" .

The compliance window will appear, click "I agree" and "Sign and Send"

The result of a successful filing will be a response page with an embedded PDF containing a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing day and time, and filer details) and, on subsequent pages, the full copy of the return.